Every year the economist for the Calgary Real Estate Board put together a forecast for the agents. Below is a summary of her predictions. The full package gets into alot more detail about the Why looking at all the indicators that influence the market such as the Regional Economy, Energy Sector, Labour Market, Net Migration,Housing Market Activity, Rental Market, New Home Market & Resale Market. For a full copy send me a request here.

CREB® forecasts a slow transition for housing in 2017

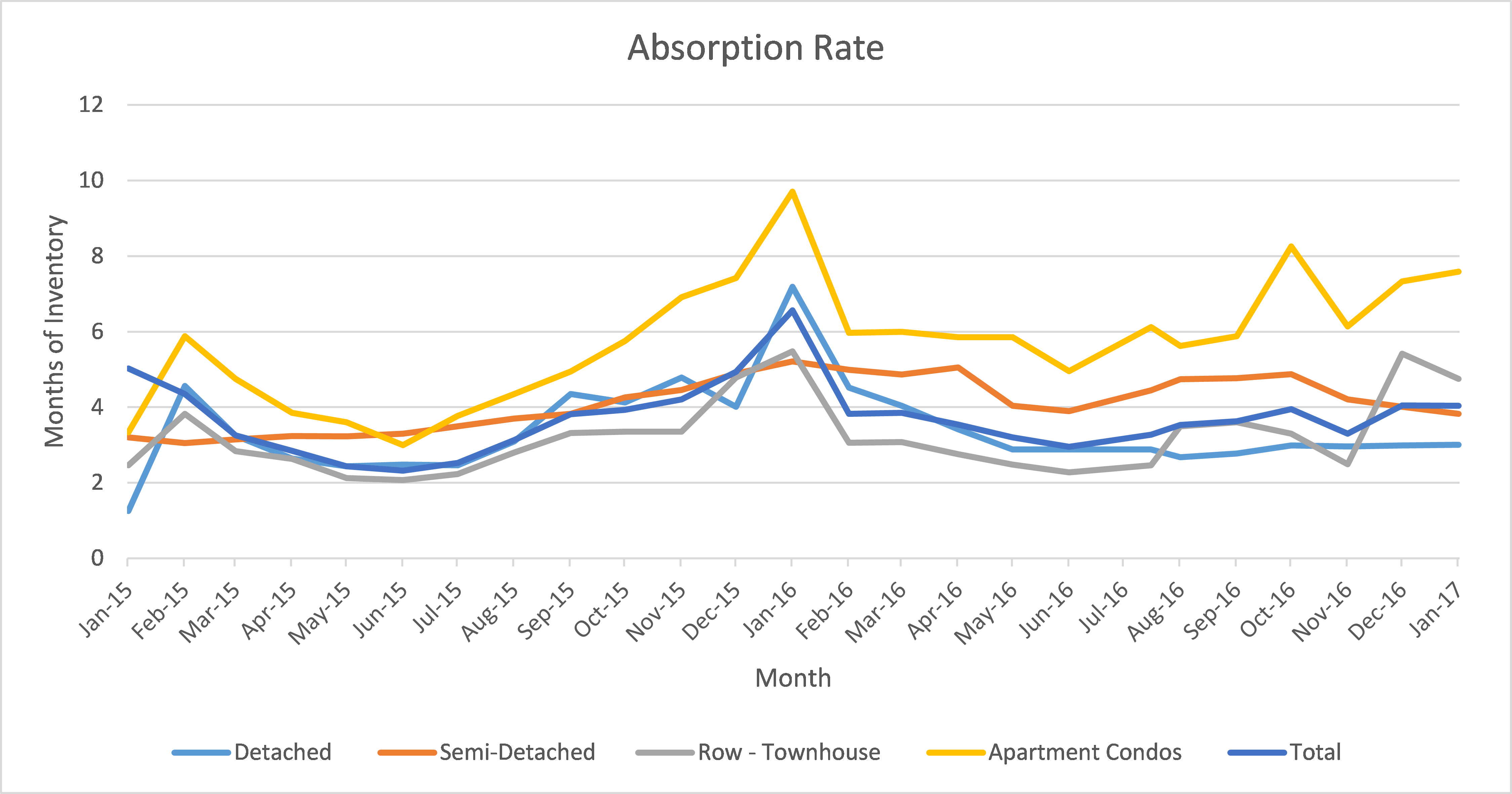

After a long period of economic downturn, Calgary’s housing market is expected to see some price stability in 2017, but not across all market segments and property types. Both detached and attached prices remain unchanged over 2016 levels, while apartment is forecasted to contract by another two per cent.

“The transition in the housing market will be a slow process,” said CREB® chief economist Ann-Marie Lurie. “We are entering the year with high unemployment rates and the possibility that job growth will not occur until the latter portion of 2017. These conditions will continue to weigh on housing demand, but supply is adjusting to weaker sales activity, which will eventually translate into price stability.”

City-wide sales are forecasted to total 18,335 units in 2017, a three per cent gain over 2016, but 12 per cent below long-term averages. This modest demand change will merge with declining listings and easing inventory in the new home market to support more balanced conditions and prevent further downward pressure on prices.

“This year is about moving away from extremely challenging conditions,” said 2017 CREB®president David P. Brown. “The transition is going to take some time, which means sellers need to stick with the fundamentals of pricing their homes correctly against other comparable product in the market. There’s still lots of choice out there for buyers, but major price declines are unlikely in most segments.”

Alberta’s economy was much softer than many predicted over the past two years, as prolonged weakness in energy weighed on other sectors of the economy, including housing. Since the start of the downturn in late 2014, price adjustments have ranged from a low of nearly five per cent in the detached sector, to a high of 11 per cent in the apartment sector. The amount of price change between these different areas of the market was based on how much oversupply there was in each sector at any given time.

Our housing market is moving toward a new equilibrium, but that shift is heavily dependent on stability in the energy sector and overall labour markets. There is also considerable risk from recent government policy changes that could derail expected gains in the second half of 2017. It’s a new outlook this year, but the market risks shouldn’t be overlooked.

For the entire CREB® forecast, contact me.