What is really happening in the Calgary Real Estate Market? Yes, there is change on the horizon!

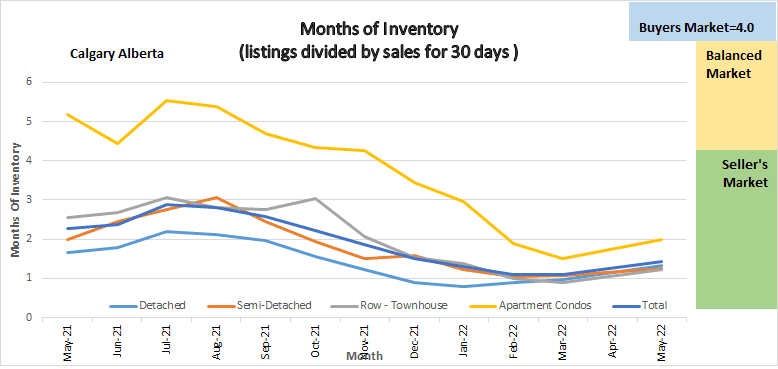

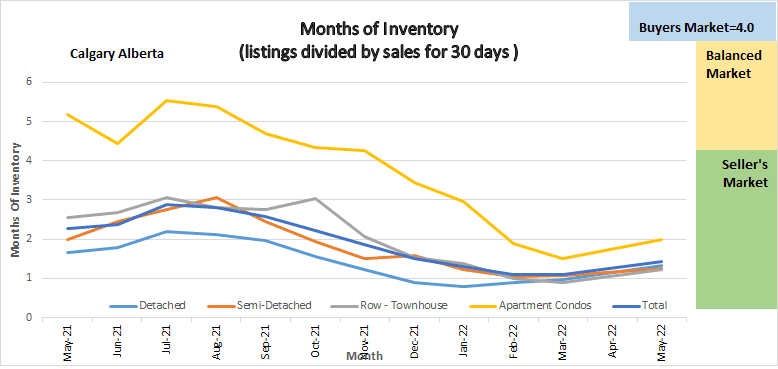

Following is a graph that shows the months of inventory for each housing sector. Looking at a one-year trendline gives you an indication of where things are really heading.

Months of Inventory

Gord’s commentary for the month (just my opinion).

March 2022 Highlights

- The direction of months of Inventory has changed and it is now increasing in all sectors – marginally!

- All Sectors of the Calgary Real Estate Market continue to be in a deep seller’s Market position

- Sales continue to be strong but are cooling from the highs we have had in recent months.

- Prices are still going up

- We are still running low on Inventory

- We are still seeing multiple offers, but the offers are now much more reasonable.

Calgary Listing Inventory

Listing inventory increased in all sectors combined by a total of 486 listings or 11.14%. The highest increase was in Detached homes at 12.2% and the lowest was in the Semi – Detached sector of 1.87%

Calgary Sales:

This is where the largest change has happened. Total Sales for the month dropped from last month by a total of 706 sales or 17.19%. The decrease was fairly consistent across all sectors.

Sales Compared to 2021:

Calgary home sales for April were just slightly higher than in April 2021 – by 197 Sales or 1.06%

| |

Jan |

Feb |

Mar |

Apr |

May |

June |

July |

| 2021 |

1207 |

1831 |

2903 |

3204 |

|

|

|

| 2022 |

2009 |

3305 |

4107 |

3401 |

|

|

|

| Change |

+ 802 |

1474 |

+1204 |

+197 |

|

|

|

| % Change |

+ 66.4% |

+180.5% |

+141.5% |

+1.06 |

|

|

|

| |

Aug |

Sept |

Oct |

Nov |

Dec |

| 2020 |

1574 |

1702 |

1763 |

1438 |

1199 |

| 2021 |

2151 |

2162 |

2186 |

2110 |

1737 |

| Change |

+577 |

+456 |

+ 423 |

+672 |

+538 |

| % Change |

136.6% |

126.7% |

123.9% |

146.7% |

144.9% |

Calgary Real Estate Benchmark Sales Prices:

The benchmark price for all sectors increased combined increased by 1.56% or $8,100. The increase was consistent across all sectors.

Calgary Real Estate Benchmark Year to Date Sales Price: See chart below.

Year to date all sectors combined have increased by $62,800 or 13.54%. The highest increase (14.91%) was in the Detached home sector while the lowest increase was in the Apartment Condo sector (8.35%).

Current Months of Inventory (Absorption Rate):

The months of inventory increased in all sectors in April by an average of .36

All sectors were equal with the lowest increase (.18) being in the Semi-Detached sector.

What might 2022 bring: (again just my opinion)

Based on what I am seeing we are on our way towards a more balanced market although if the increase in months of inventory rises at the same rate that it has been it will take us between 2 to 3 months to hit balanced. Apartment condos may reach balanced within 1-2 months. With all sectors still in a Sellers Market position we will continue to see price increases – just not to the level it has been the last 3 months.