What is really happening in the Calgary Real Estate Market?

The market is a result of Supply and Demand therefore we look at both Supply (inventory) and Demand (Sales) and the relationship between the two. We also update you on the current benchmark price for all housing sectors.

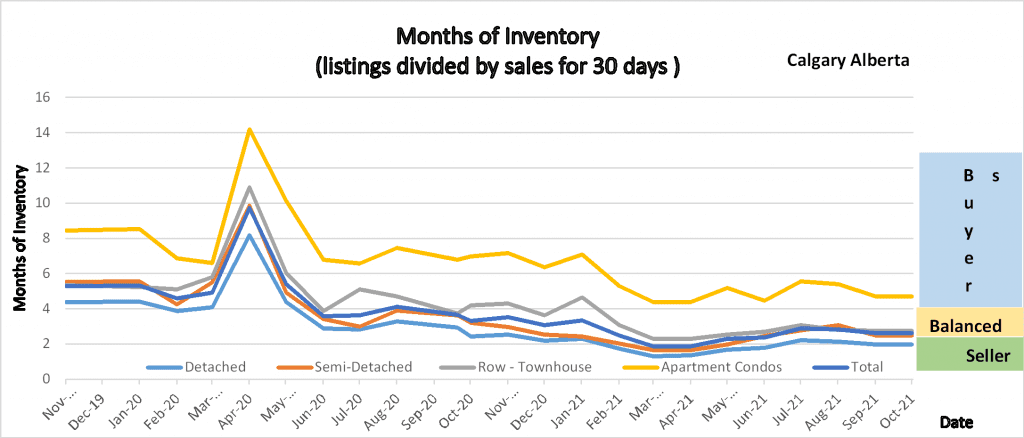

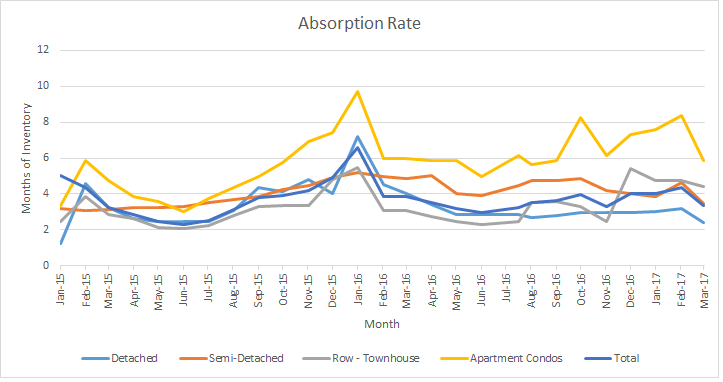

Following is a graph that shows the months of inventory for each housing sector. Looking at a 2-year trendline gives you an indication of where things are really heading.

Gord’s commentary for the month (just my opinion).

October continued with very strong sales and a declining inventory level pushing the market into a stronger seller’s market position.

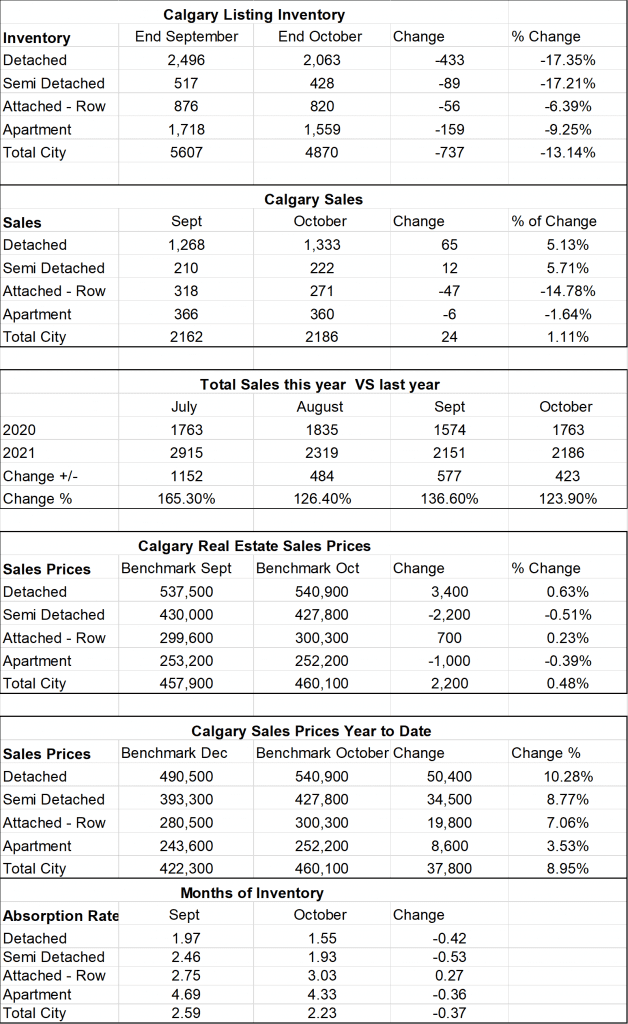

Calgary Listing Inventory

Listing inventory in all sectors declined again this month. This is a normal trend where we see the number of new listings decline between now and the new year.

Calgary Sales:

Another strong month in Calgary Real Estate. Sales in October increased (by 24) over sales from September. Typically, we see sales decline at this time of year, so an increase is a little unusual. Sales in attached Row and Apartment did show decreases while Detached and Semi-Detached homes increased from September.

Sales Compared to 2020:

As you can see below October 2021 Sales were higher than October 2020. As noted above this is due to pent-up demand and a lack of supply making people search longer to find their home. The other factor here is people taking advantage of the low-interest rates.

| Jan | Feb | Mar | Apr | May | June | |

| 2020 | 861 | 1190 | 1175 | 573 | 1080 | 1763 |

| 2021 | 1208 | 1836 | 2903 | 3209 | 2989 | 2915 |

| Change | +347 | +646 | +1729 | +2639 | 1,911 | 1,152 |

| % Change | +7.49 | +54.4 | 247% | +562% | 277.3% | 165.3% |

| July | Aug | Sept | Oct | Nov | Dec | |

| 2020 | 1835 | 1574 | 1702 | 1763 | 1437 | 1199 |

| 2021 | 2319 | 2151 | 2162 | 2186 | ||

| Change | +484 | +577 | +456 | + 423 | ||

| % Change | 126.4% | 136.6% | 126.7% | 123.9% |

Calgary Real Estate Benchmark Sales Prices:

Overall, the benchmark price changed very little this month. The total change for all sectors was an increase of $2200. Semi-Detached Homes and Apartment Condos saw a small decline while Detached homes and Attached Row homes saw a small increase.

Calgary Real Estate Benchmark Year to Date Sales Price: See chart below.

Current Months of Inventory (Absorption Rate):

The Months of inventory decreased in all sectors except Attached Rowhomes. This is due to the declining inventory and increased sales. This puts Detached homes, Semi-Detached Homes, and the overall market into a seller’s market position. Attached Row homes stayed in a balanced position while Apartment Condos stayed in a Buyers Market Position.

It is also important to note that these numbers vary by community, and by price range. If you would like numbers for your community, or more specific numbers for your home please contact us.

Below is a summary of numbers in chart form. All numbers are taken from the Calgary Real Estate Boards monthly Stats package.