What is really happening in the Calgary Real Estate Market?

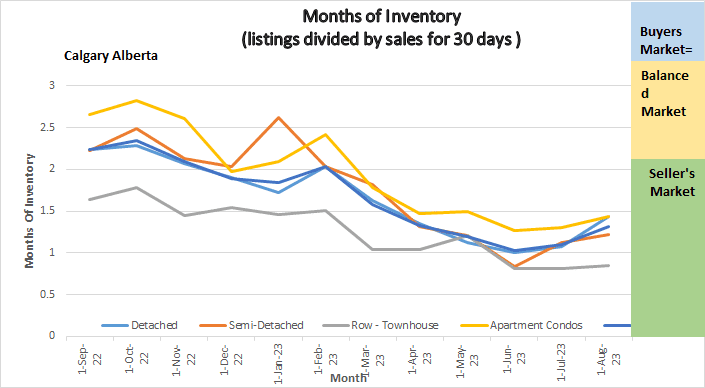

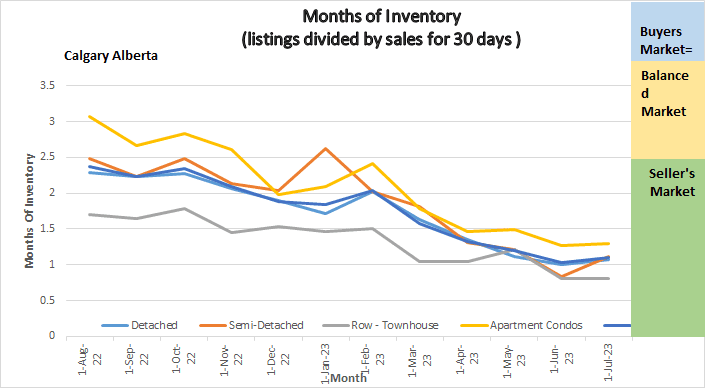

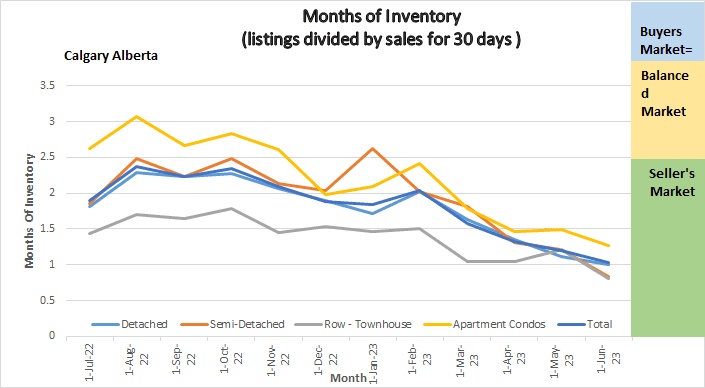

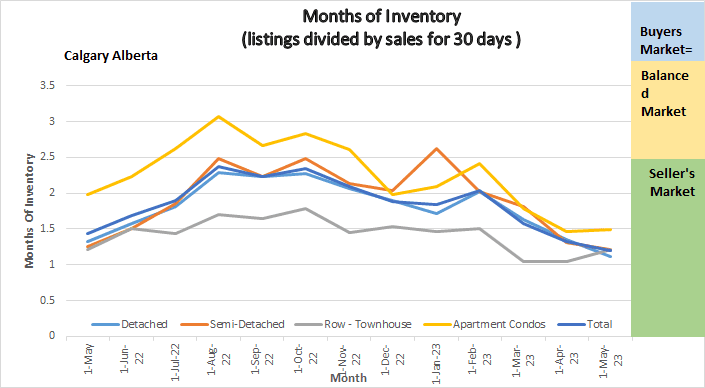

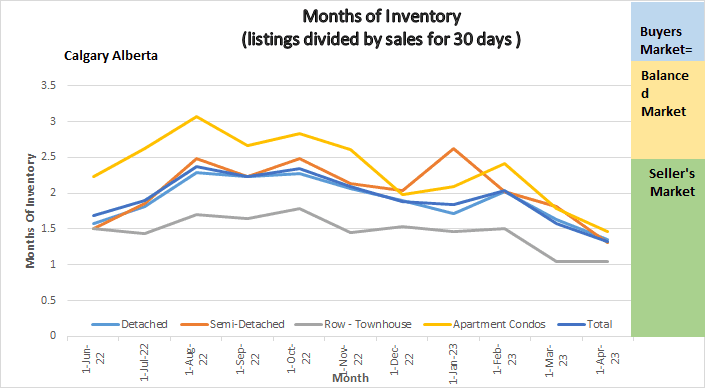

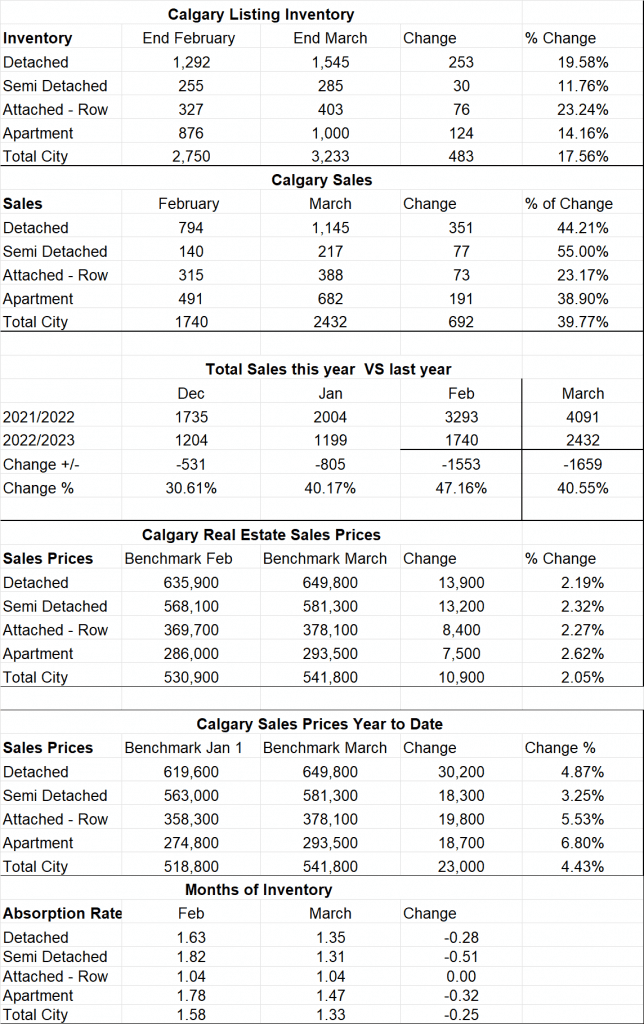

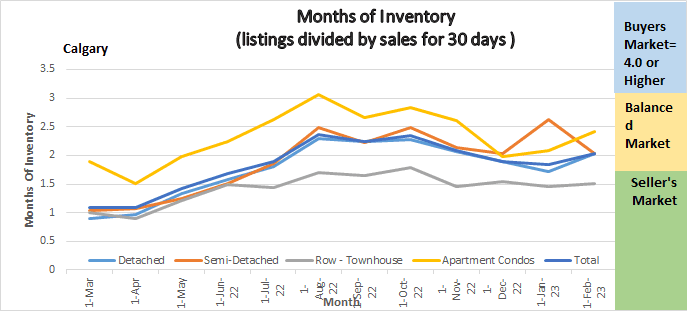

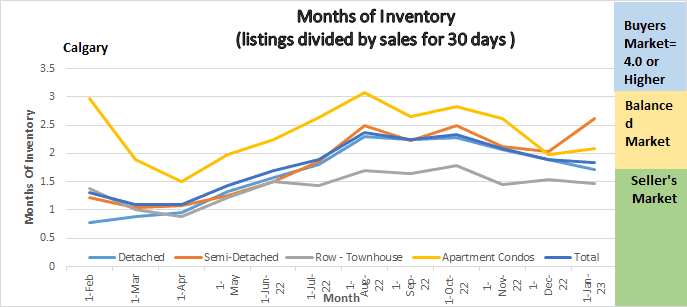

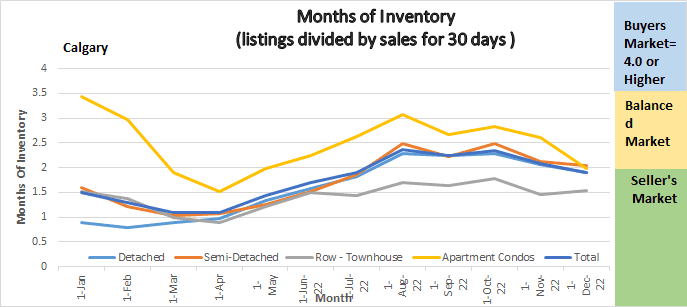

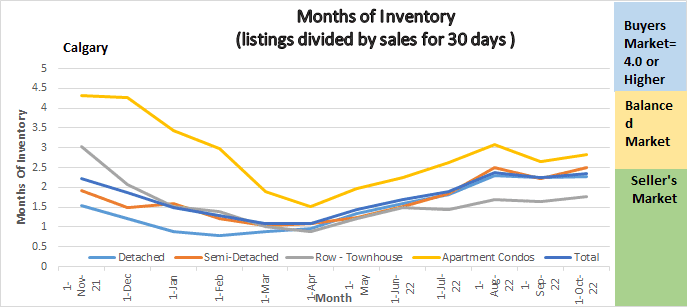

Following is a graph that shows the months of inventory for each housing sector. Looking at a one-year trendline gives you an indication of where things are really heading.

Gord’s commentary for the month (just my opinion).

July 2023 Highlights

The Calgary Market is maintaining its strength, although there are signs of change on the horizon.

- Sales were the strongest July on record.

- Months of Inventory increased by .22 for the month.

- We remain in a deep seller’s market.

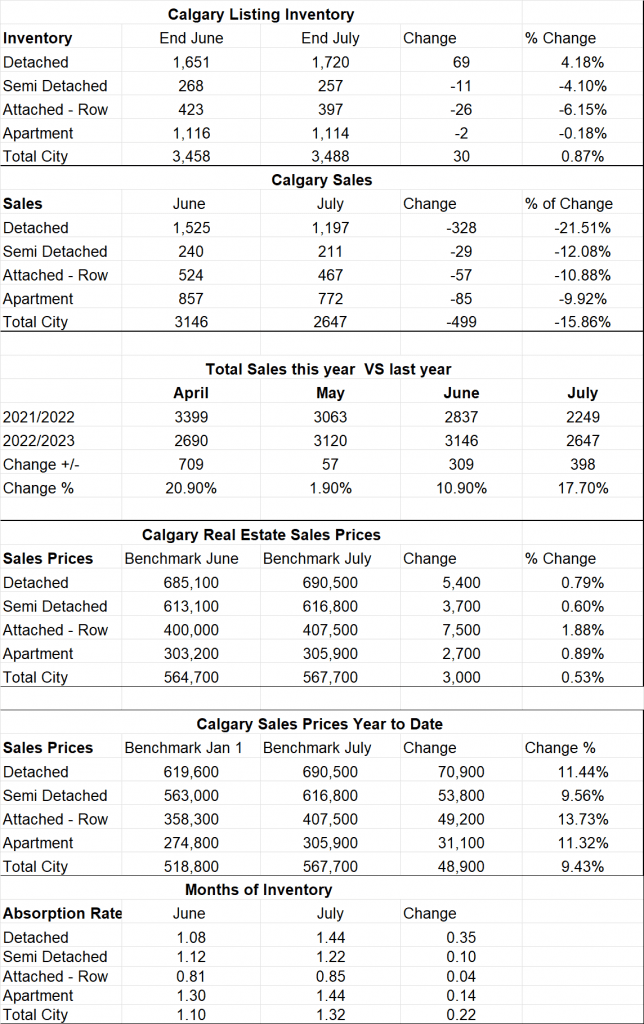

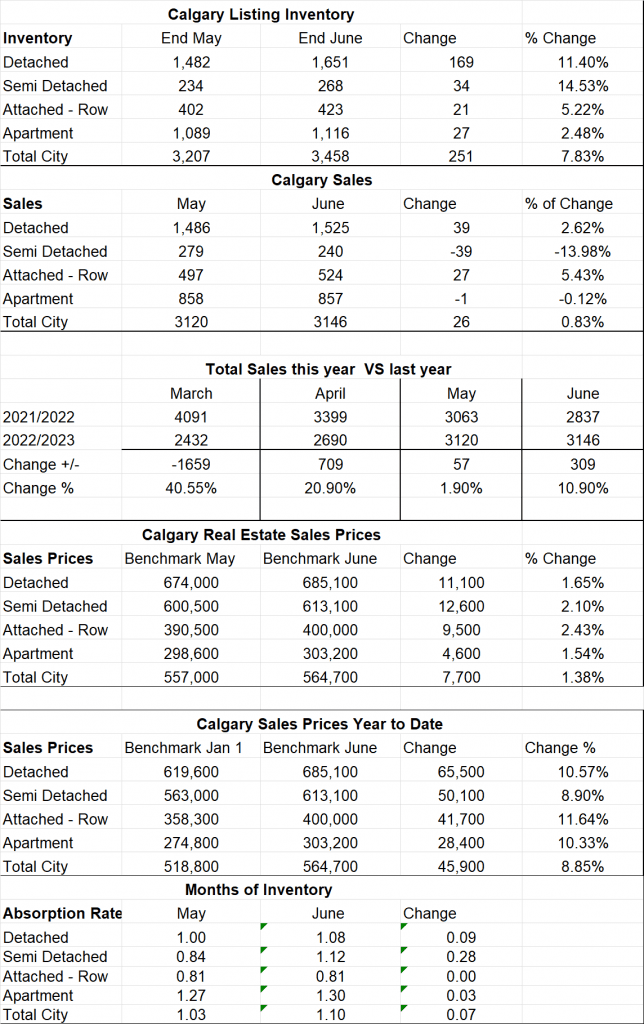

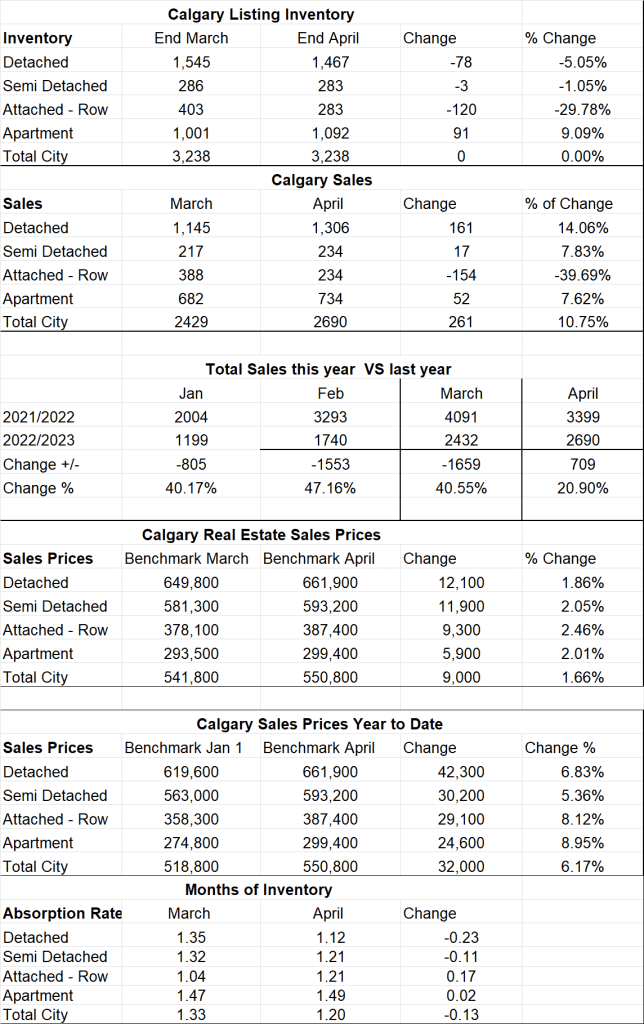

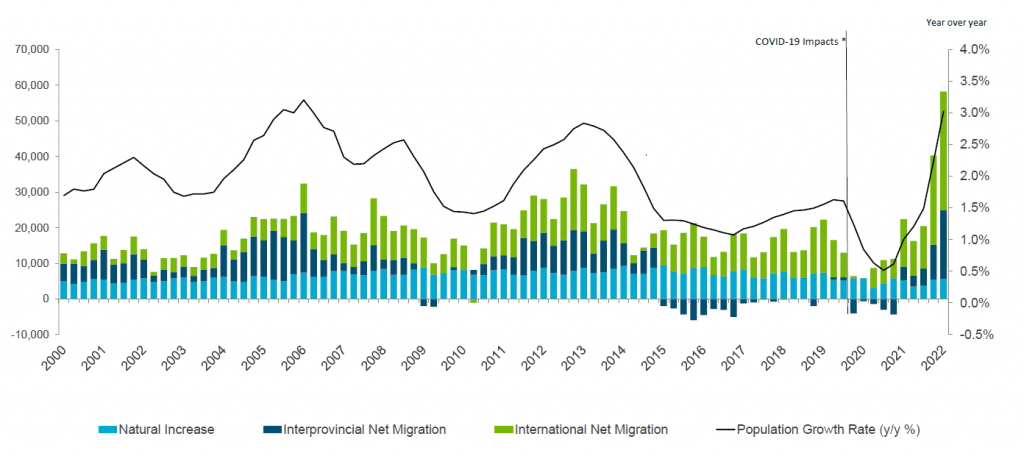

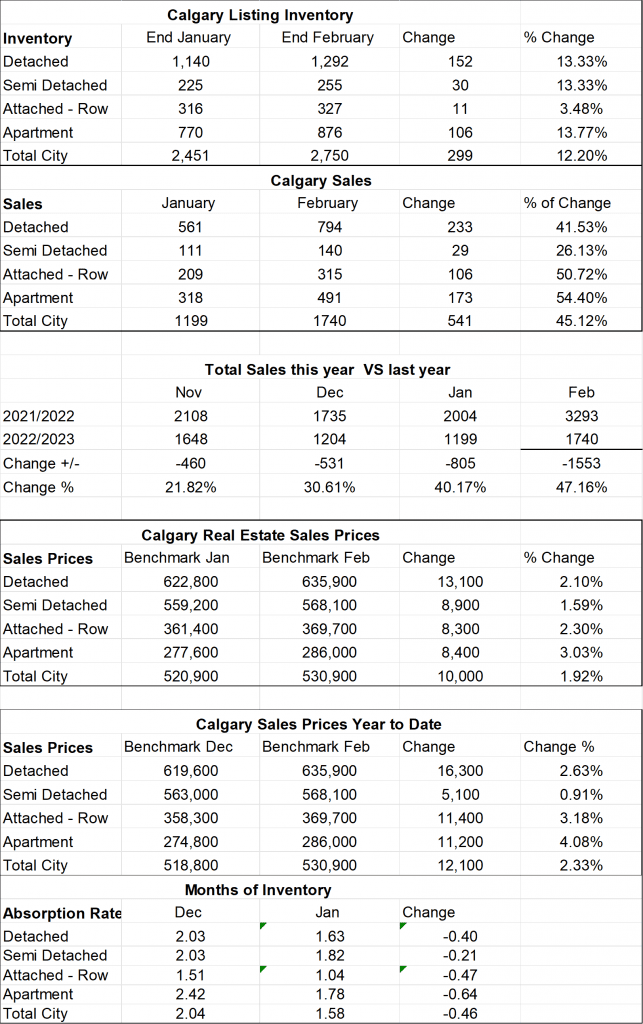

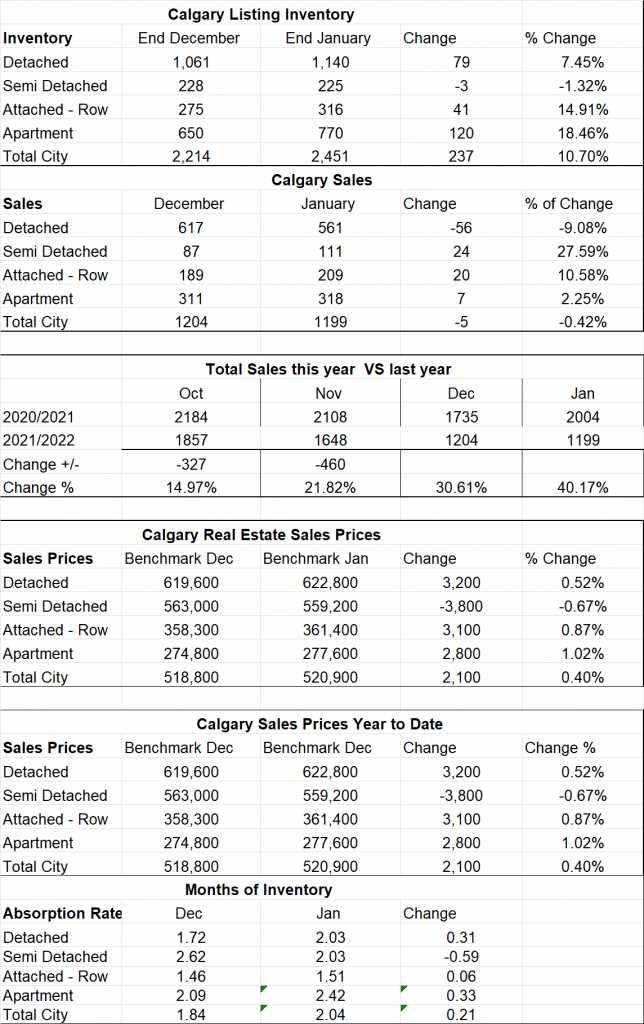

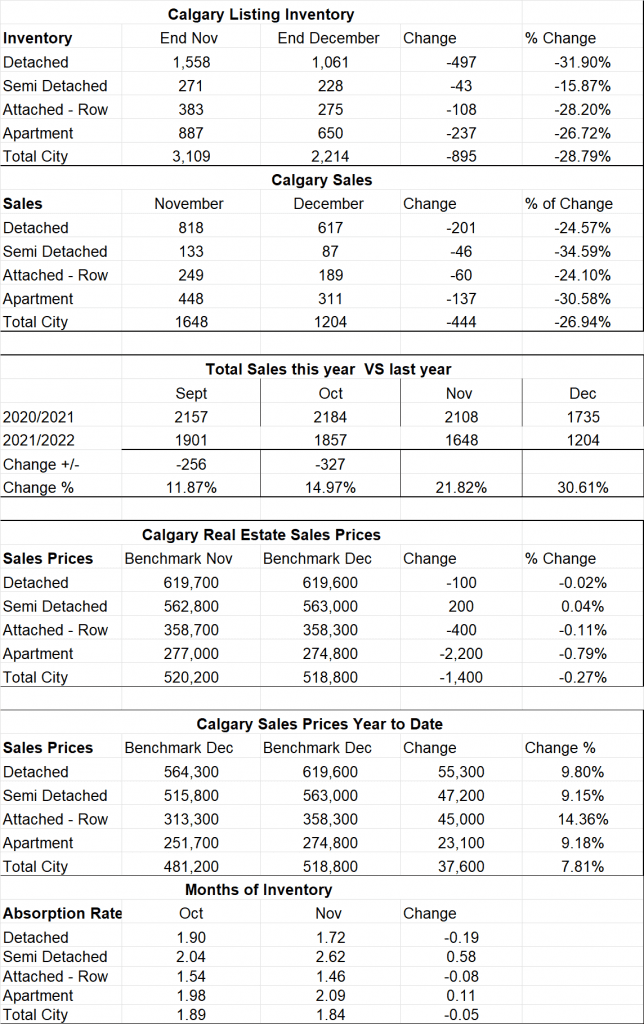

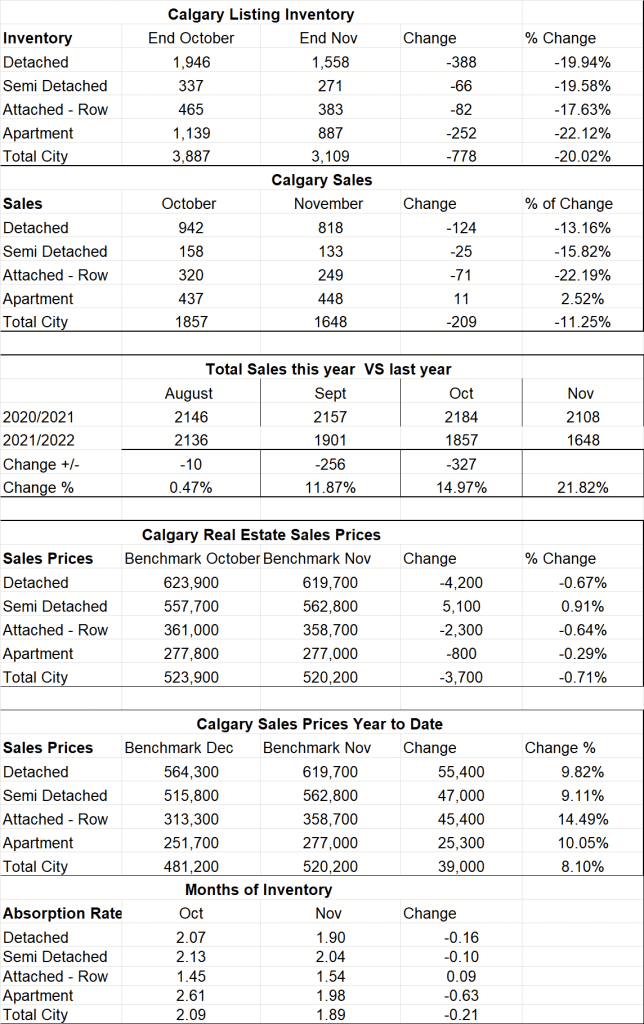

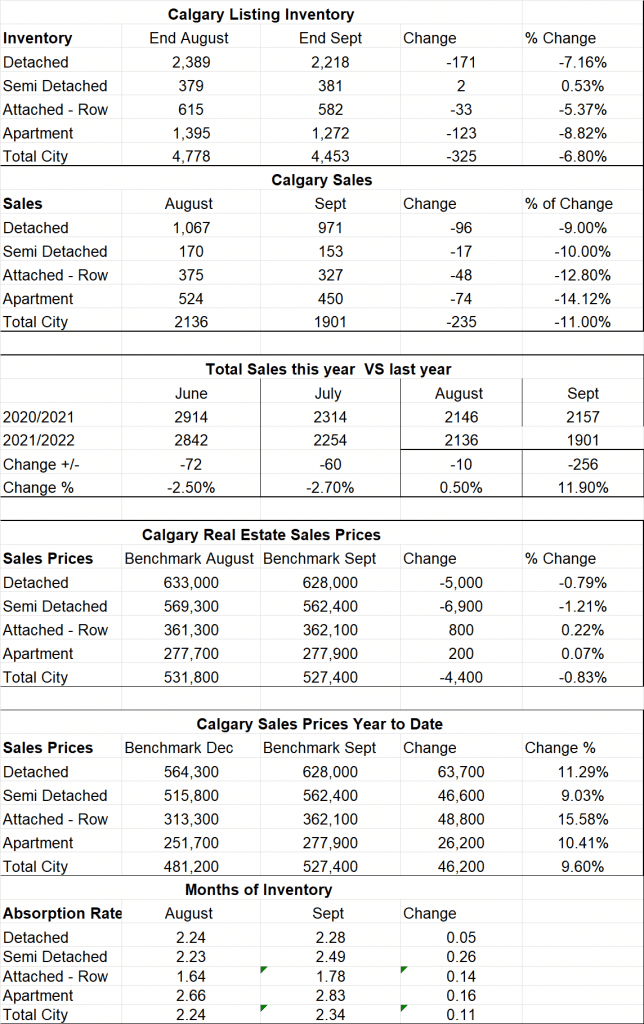

Calgary Listing Inventory

Our listing inventory remains very low with a total of 3488 listings on the market, an increase of 30 since July 1, 2023. Its important to note that new listings are trending slightly up, but they are being absorbed so the inventory is not increasing at a pace we typically expect at this time of the year.

Calgary Sales:

Sales in July were 2647 making this the best July on record with the Calgary Real Estate Board. Sales were down by 499 compared to June but it is normal that once we hit July sales decline every month until the end of the year. What’s interesting is that sales were 309 higher than last year.

Sales Compared to 2022:

It is also important to look at sales compared to the Previous year. Sales for April were 711 less than last year. Again, in my opinion this is simply due to not having enough Inventory on the market.

| Jan | Feb | Mar | Apr | May | June | July | |

| 2022 | 2004 | 3305 | 4091 | 3401 | 3071 | 2837 | 2249 |

| 2023 | 1199 | 1740 | 2432 | 2690 | 3120 | 3146 | 2647 |

| Change | -805 | -1565 | -1659 | -711 | +57 | +309 | +398 |

| % Change | -40.1% | -47.4% | -40.55% | -20.9% | +1.9% | +10.9% | +17.7% |

Calgary Real Estate Benchmark Sales Prices:

The overall benchmark price continues to increase. The overall benchmark price increased by $3000 or .53%. The largest gain was in the Attached -Row sector with an increase of $7,500 which happens to be the same sector that saw the smallest increase in months of inventory.

Calgary Real Estate Benchmark Year to Date Sales Price: See chart below.

For all of Calgary we have so far seen an increase in all sectors of 9.43% or $48,900. The lowest dollar increases so far has been apartment condos at $31,100 and the highest is Detached homes at $70,900.

Current Months of Inventory (Absorption Rate):

Months of Inventory has increased for the second month in a row, which tells me that the direction is changing. Our overall months of inventory is 1.32. Months of inventory below 2.5 indicates a seller’s market so we are still deep in a seller’s market. The largest increase in Months of Inventory was in the Detached sector increasing by .35. Note the Attached-Row sector saw the smallest increase of .10.

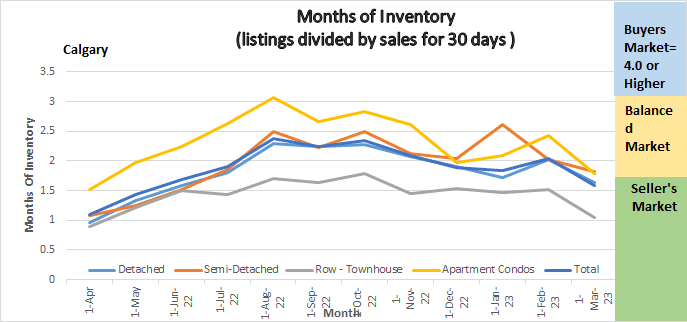

My Prediction for what is ahead: Based on what is driving demand (largely immigration) and I do not see that changing any time soon, I predict sales are going to remain strong and prices are going to continue to trend upwards although based on trends I see us slowly climbing out of the seller’s market.

*All numbers vary by community and price ranges, if you would like stats specifically for your neighbourhood, please contact us.

See Stats from the Calgary Real Estate Market Below