What is really happening in the Calgary Real Estate Market?

Stay ahead of everyone else by following our Monthly Market Snapshot of the Calgary Real Estate Market This shows what’s really happening! The market is driven by supply and demand so here we show the inventory (supply) and sales (demand) and most importantly the relationship between the two and how it affects the price of Calgary Real Estate. A simple way to keep up to date with how the market is trending and to stay ahead of most! All numbers are taken from the Calgary Real Estate Boards Stats package for Realtors. I have also included some general comments which are simply my opinion.

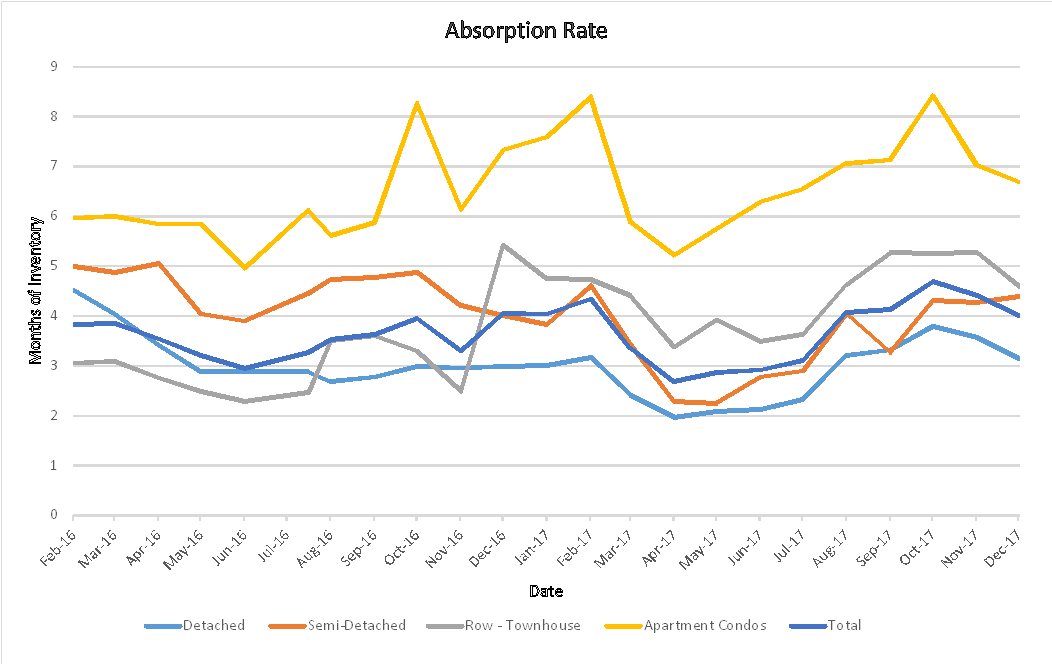

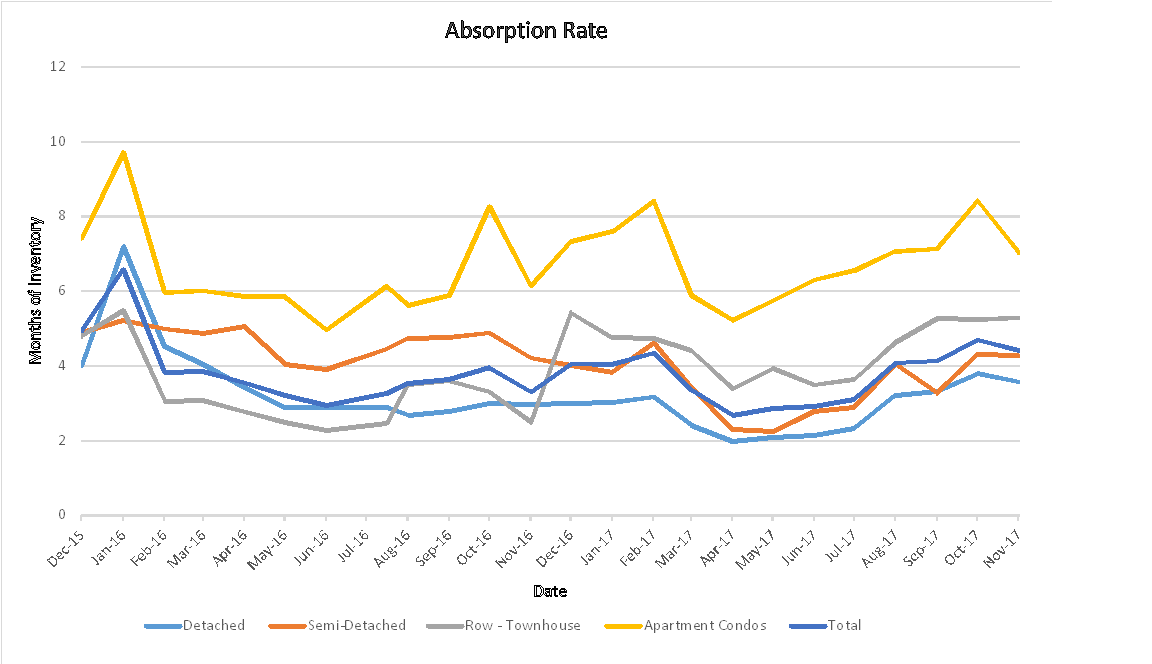

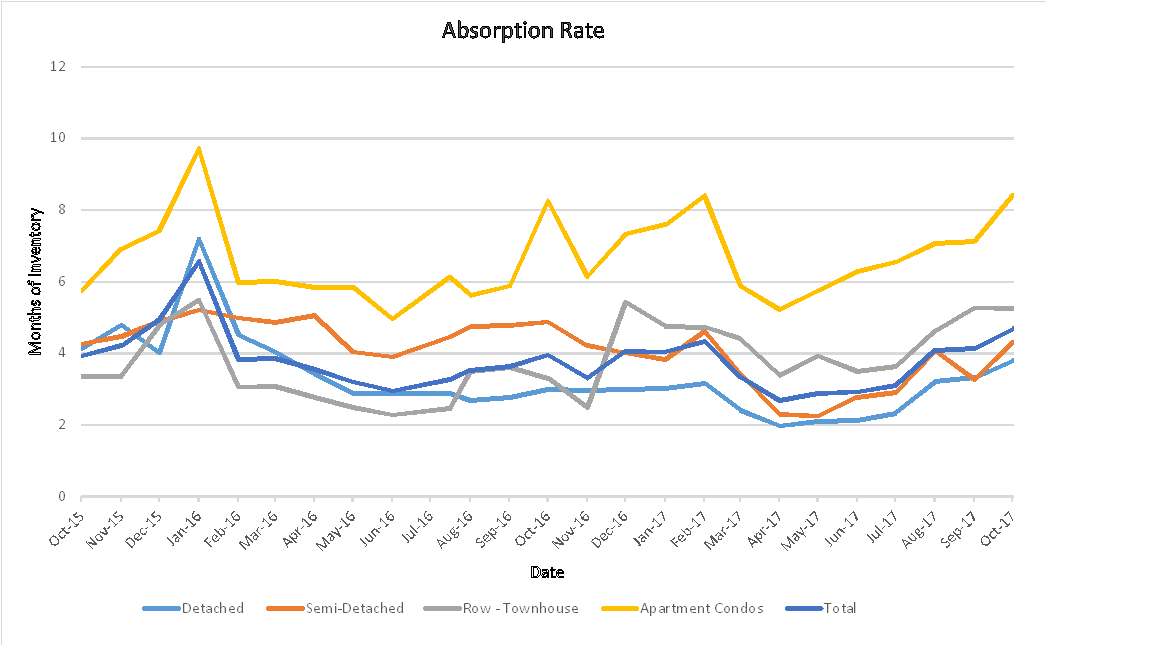

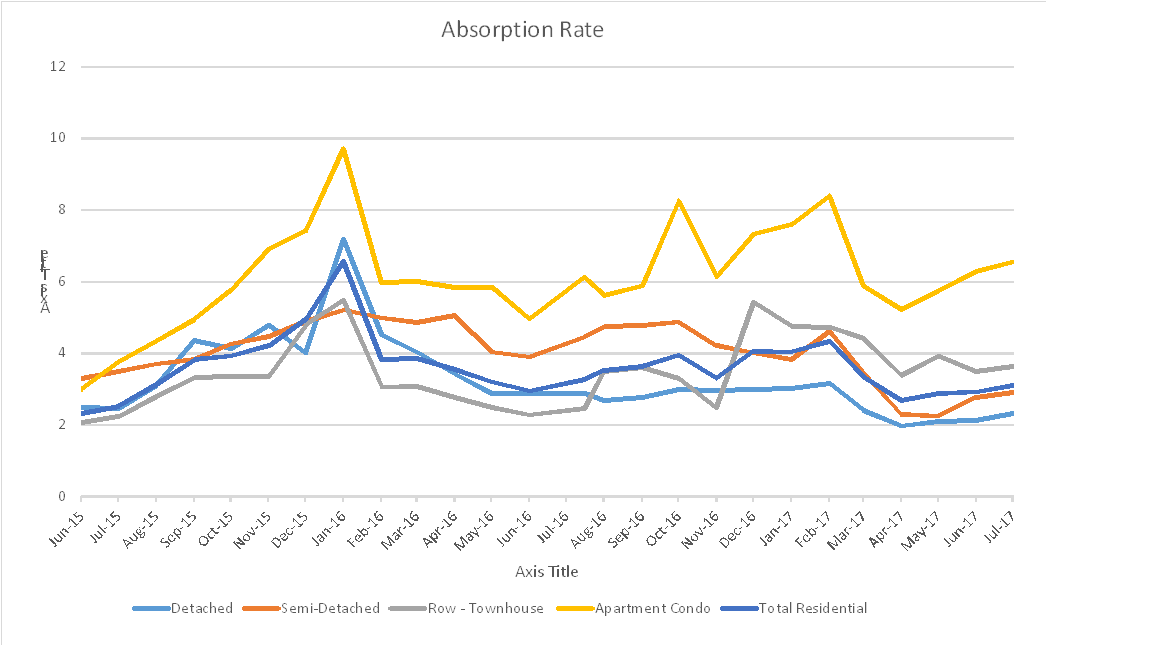

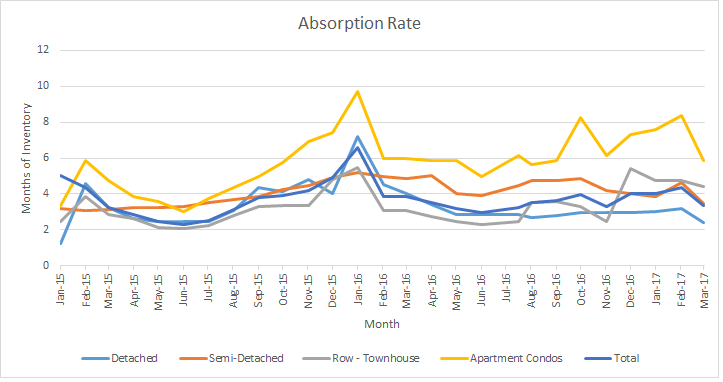

Absorption Rate (Months of Inventory) (the inventory divided by the number of sales in the last month). What does this mean you might ask?

| Buyer’s Market | >4.0 | Drives prices down |

| Balanced Market | Between 2.4 to 4.0 | Prices typically remain stable |

| Seller’s Market | <2.4 | Drives prices up |

Current Absorption Rate

The Absorption rate for November increased in all categories for December. The number of listings dropped but the number of sales dropped even more. My concern is that a lot of inventory came off for the holiday season and we may see a ton of listings hit the market in January.

| Nov 2017 | Dec 2017 | Change | |

| Detached | 3.15 | 3.30 | 0.15 |

| Semi Detached | 4.40 | 4.64 | 0.24 |

| Attached – Row | 4.60 | 5.22 | 0.62 |

| Apartment | 6.69 | 6.99 | 0.31 |

| Total City | 4.01 | 4.28 | 0.26 |

Calgary Listing Inventory

In December all categories saw a decrease in the number of listings. This is normal for this time of year where people will let their listing expire and then put it back on in the new year.

| Inventory | Nov 2017 | Dec 2017 | Change |

| Detached | 2758 | 2033 | -725 |

| Semi Detached | 555 | 441 | -114 |

| Attached – Row | 861 | 658 | -203 |

| Apartment | 1491 | 1182 | -309 |

| Total City | 5665 | 4314 | -1351 |

Calgary Sales:

Sales for December decreased in all categories. Of interest our sales in all categories exceeded the sales for Dec 2016.

Total sales Dec 2016: 929

Total sales Dec 2017: 1006

Increase of 8.3%

| Calgary Sales | Nov 2017 | Dec 2017 | Change | % Change |

| Detached | 875 | 616 | -259 | -29.60% |

| Semi Detached | 126 | 95 | -31 | -24.60% |

| Attached – Row | 187 | 126 | -61 | -32.62% |

| Apartment | 223 | 169 | -54 | -24.22% |

| Total City | 1411 | 1008 | -403 | -28.56% |

Calgary Real Estate Sales Prices:

Prices in December dropped a little in all categories. The highest decreases were in detached and attached-row houses.

| Sales Prices | Nov 2017 Benchmark Price | Dec 2017 Benchmark Price | Change |

| Detached | 504,000 | 499,600 | -4,400 |

| Semi Detached | 417,800 | 416,600 | -1,200 |

| Attached – Row | 303,100 | 299,500 | -3,600 |

| Apartment | 258,300 | 257,700 | -600 |

| Total City | 436,700 | 433,200 | -3,500 |

Sales Prices “Year to Date”

Well, here is the summary for the year 2017. Small gains in Detached and Semi-Detached homes and a small reduction in Attached Row with a larger decrease in Apartment Condos. If you have been watching my report for the year the absorption rate for apartment condos has been very high all year.

| Sales Prices | Jan 1, 2017 Benchmark Price | Dec 2017 Benchmark Price | Change

$ |

% Change |

| Detached | 498,900 | 499,600 | 700 | 0.14% |

| Semi Detached | 406,200 | 416,600 | 10,400 | 2.56% |

| Attached – Row | 303,100 | 299,500 | -3,600 | -1.19% |

| Apartment | 266,500 | 257,700 | -8,800 | -3.30% |

| Total City | 434,100 | 433,200 | -900 | -0.21% |

**Please note that these numbers include only Calgary homes and do change on a community basis and more so for towns. This report does not include rural properties. If you would like to find stats on your community just let me know. If you have any questions about this summary or Real Estate questions please feel free to contact us.

My Prediction for 2018

The big news is that as of yesterday the mortgage rules changed and people will be able to qualify for less mortgage due to the new “Stress Test”

When the government made the same change for 5% Down mortgages we saw little impact in the market so I am predicting little impact on the market due to this. If anything we will see less sales activity in Detached homes and some buyers will move into attached homes or Townhomes. Some who could previously qualify for a townhouse may now move into the Apartment Condo sector. For Calgary if this prediction comes true it could be good as it may balance out the market categories. Overall I believe that the Calgary Market will continue to pick up momentum through 2018.

Happy New Year, we hope you have an awesome 2018.