What is really happening in the Calgary Real Estate Market?

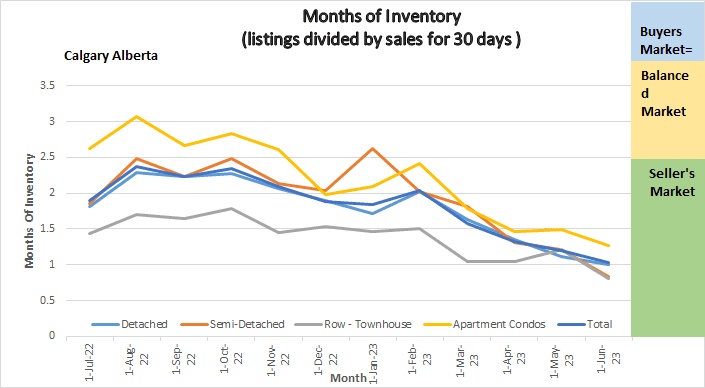

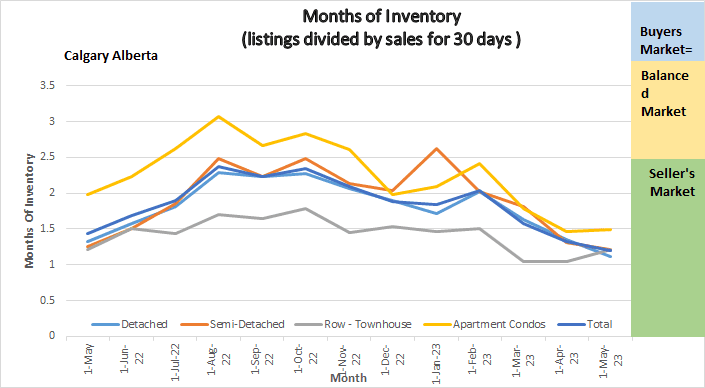

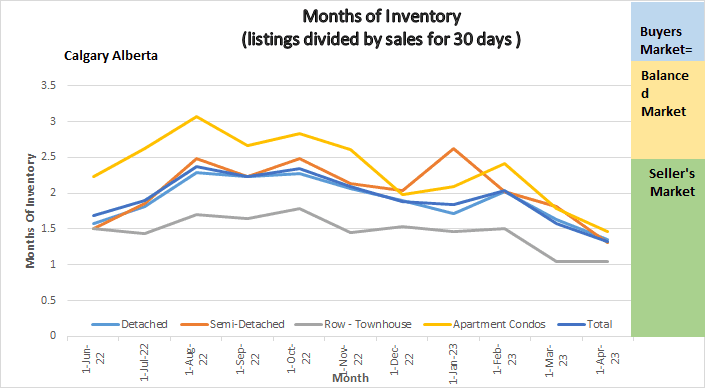

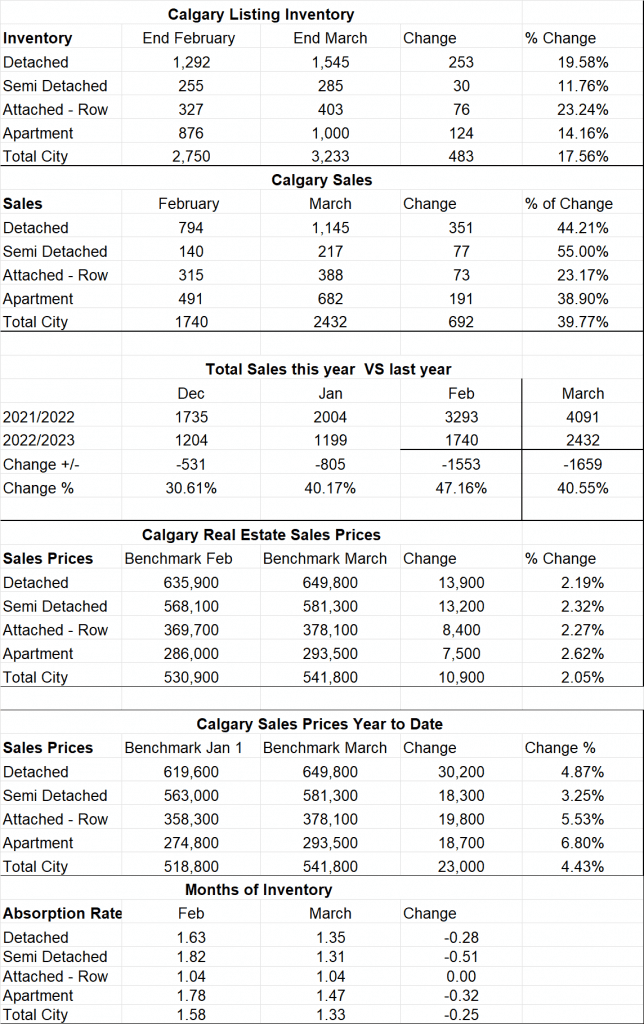

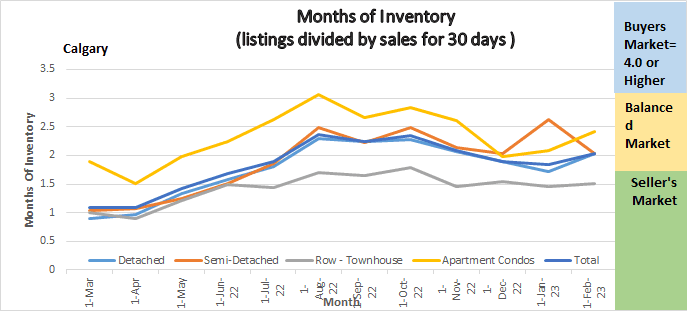

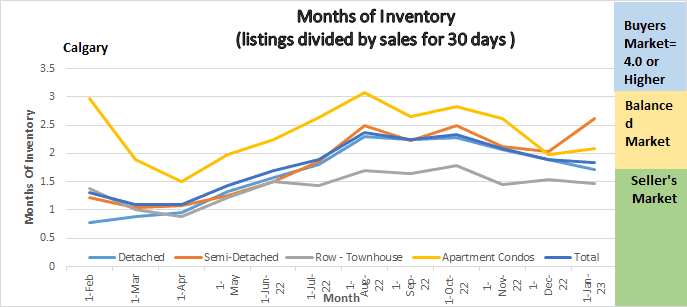

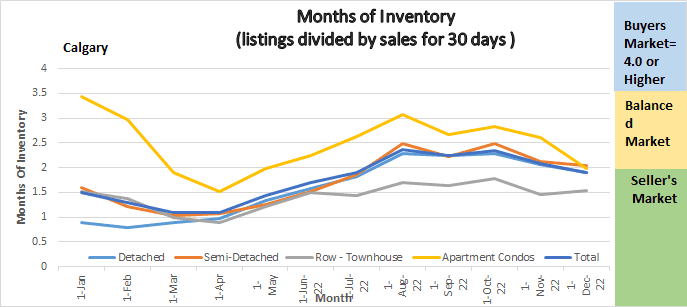

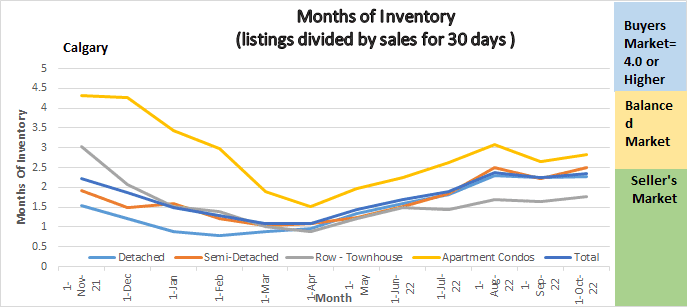

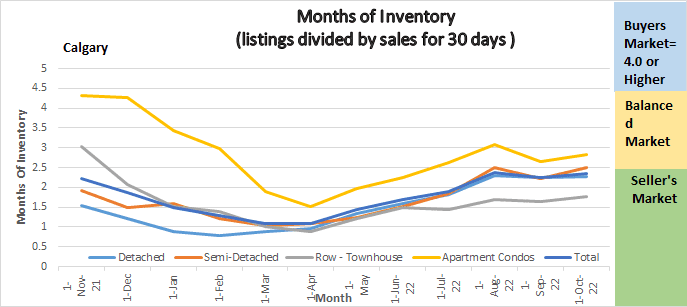

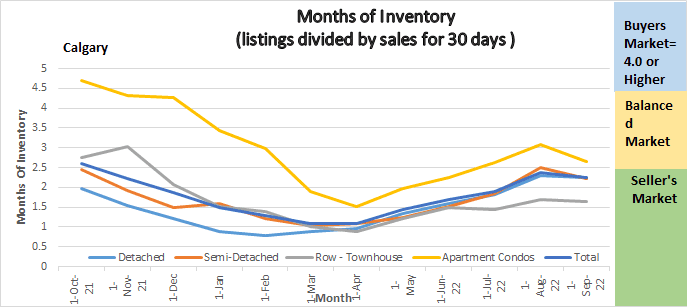

Following is a graph that shows the months of inventory for each housing sector. Looking at a one-year trendline gives you an indication of where things are really heading.

Gord’s commentary for the month (just my opinion).

May 2023 Highlights

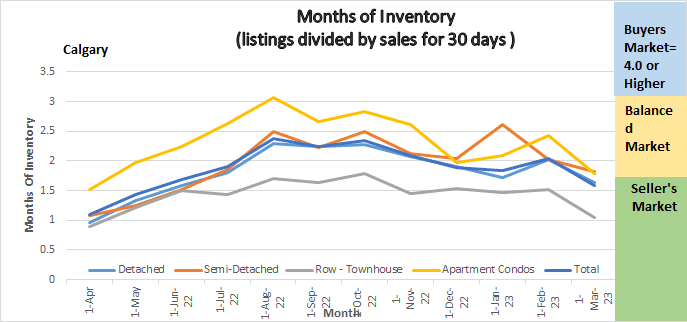

The Calgary Market is continuing at a blistering pace!

- Months of Inventory declines again

- Prices continue the upward trend.

- New listings increased resulting in a sale increase.

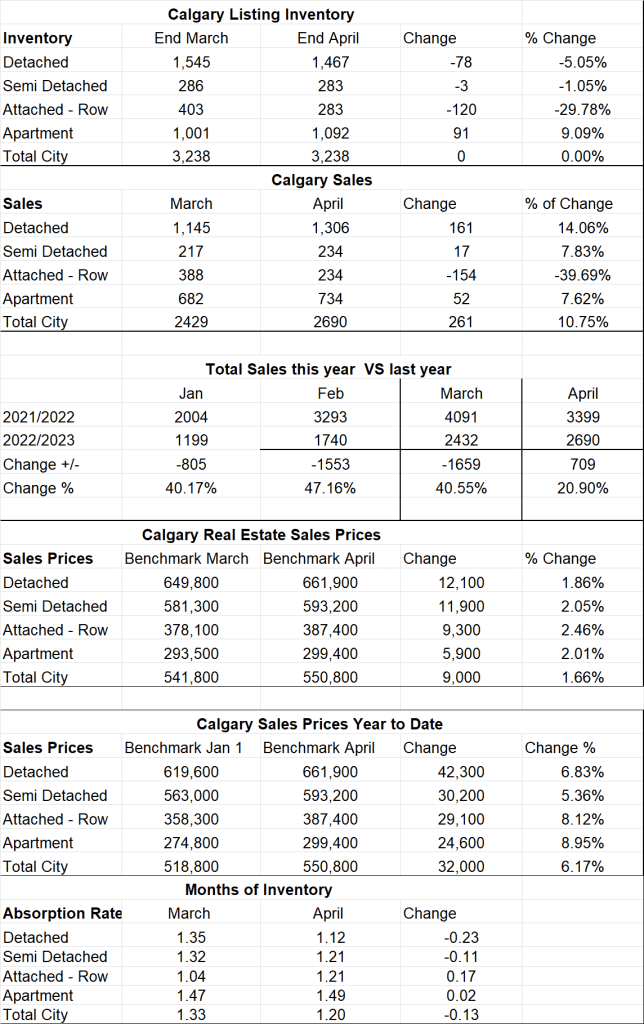

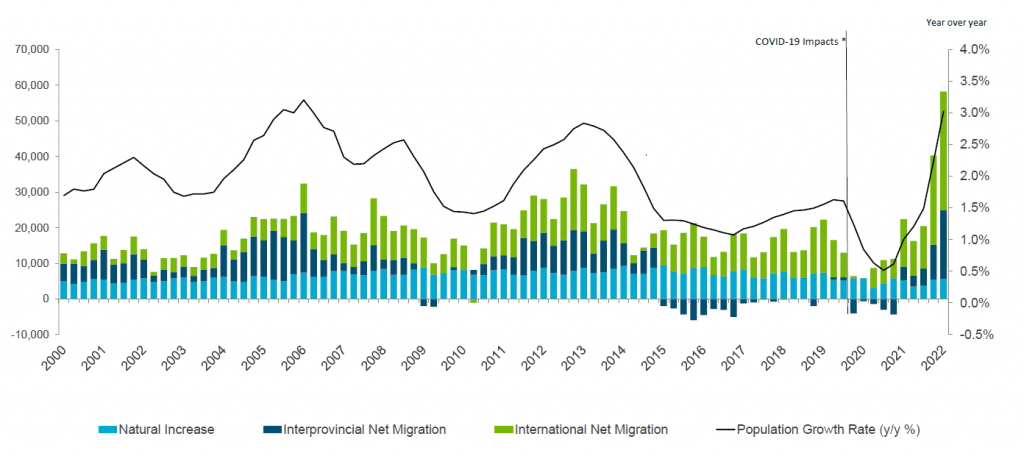

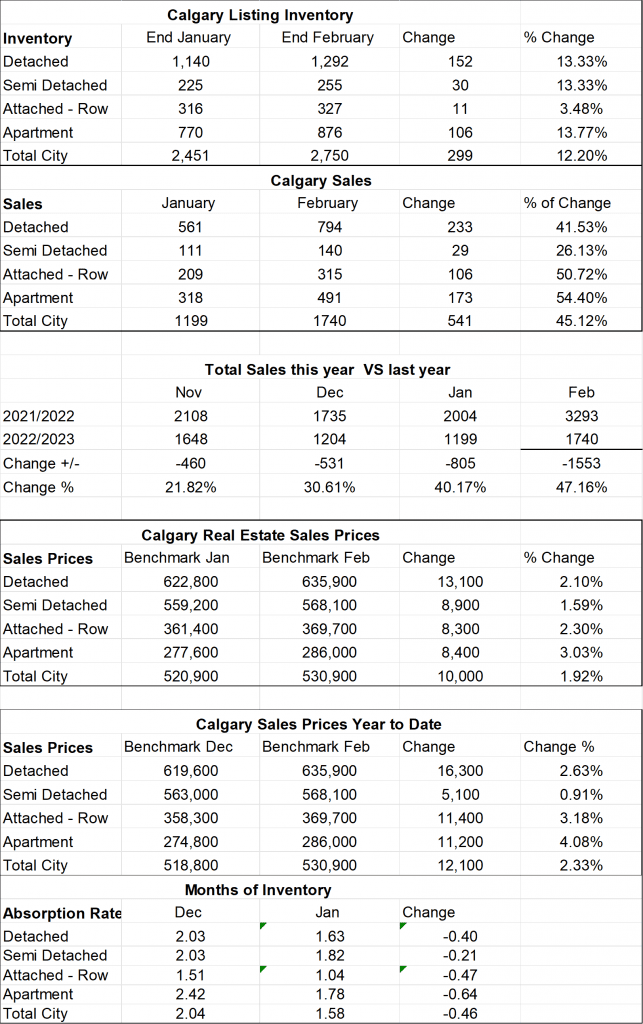

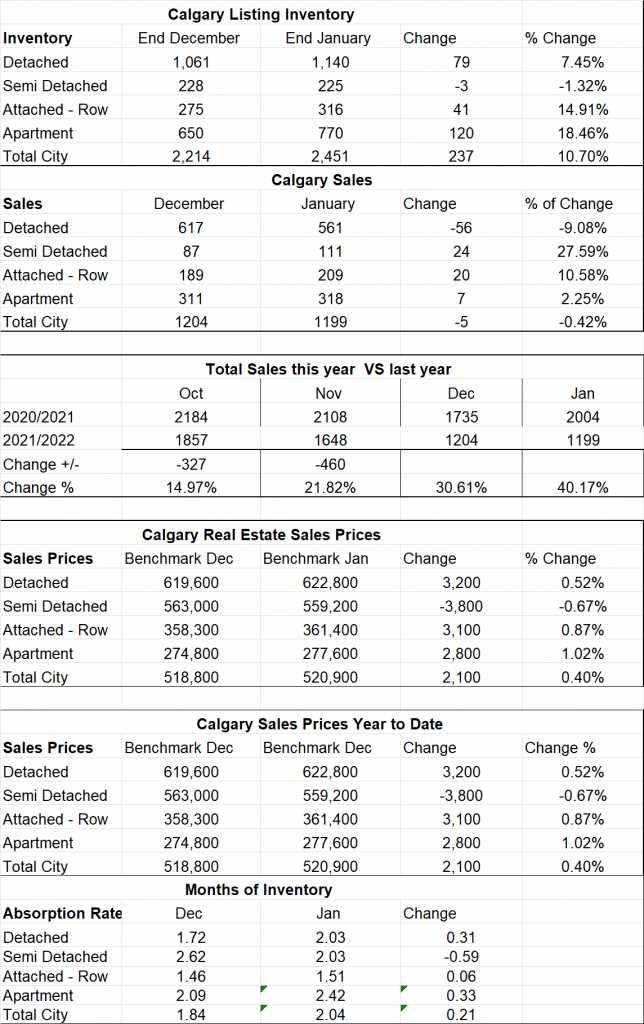

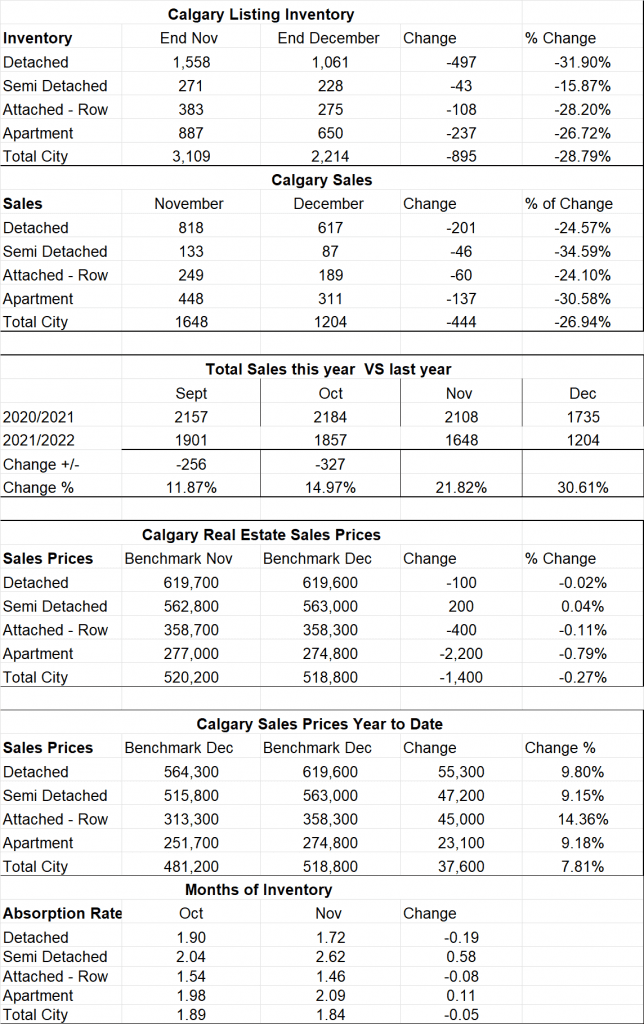

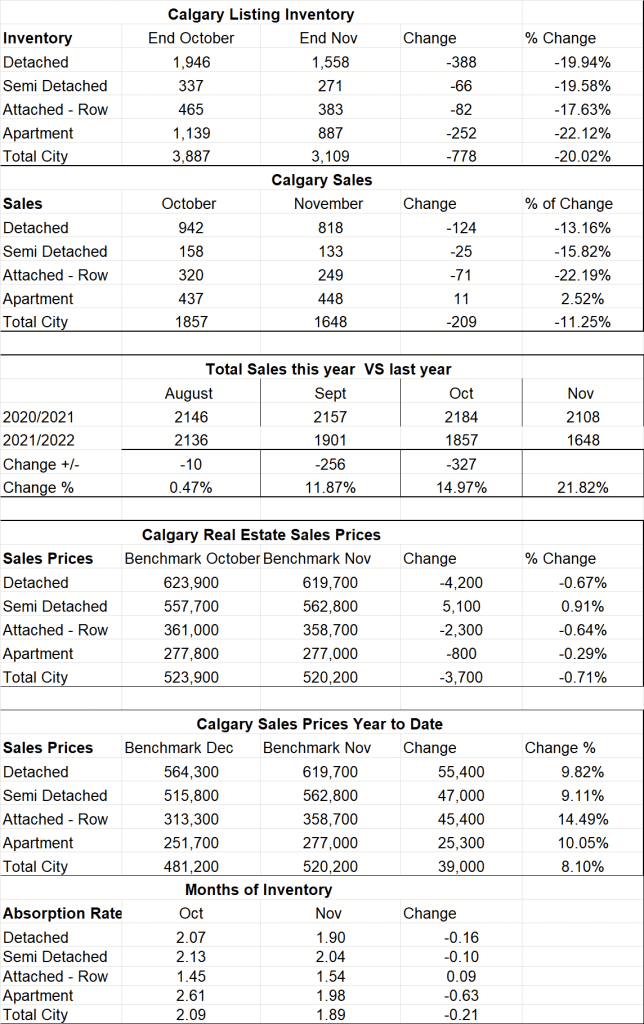

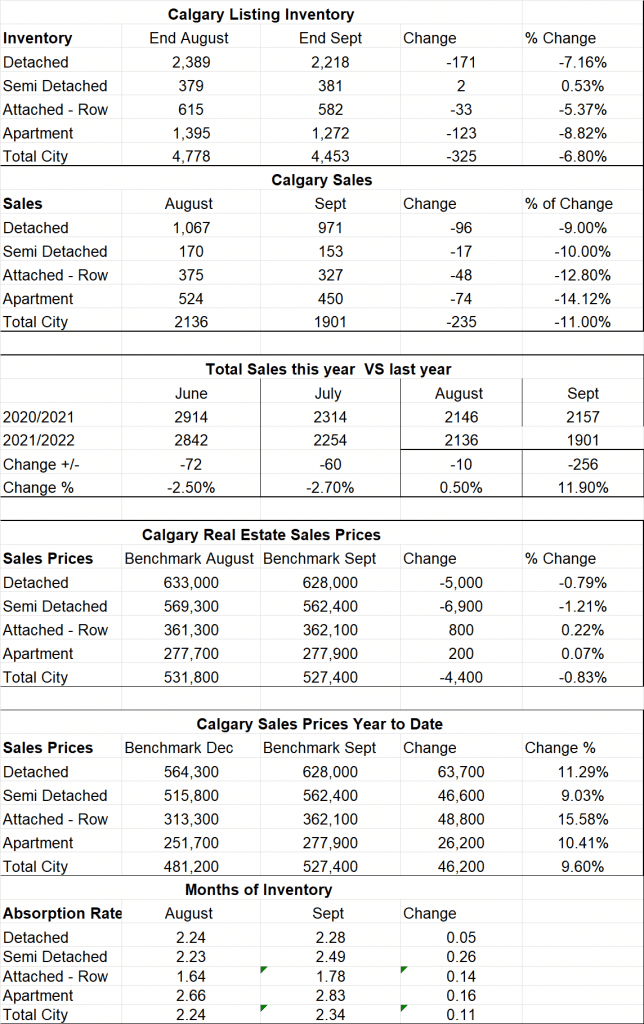

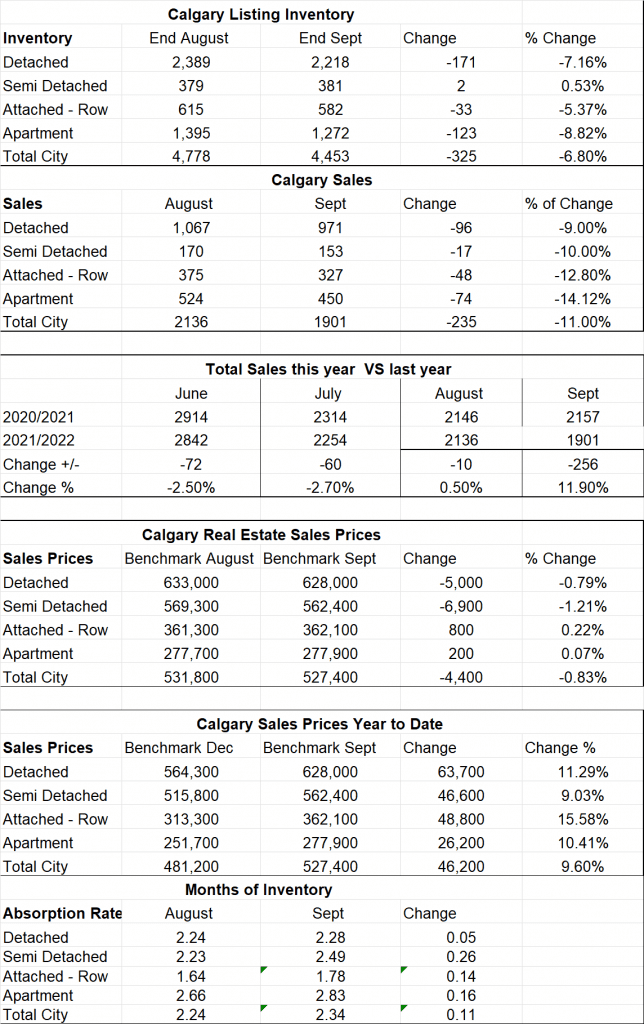

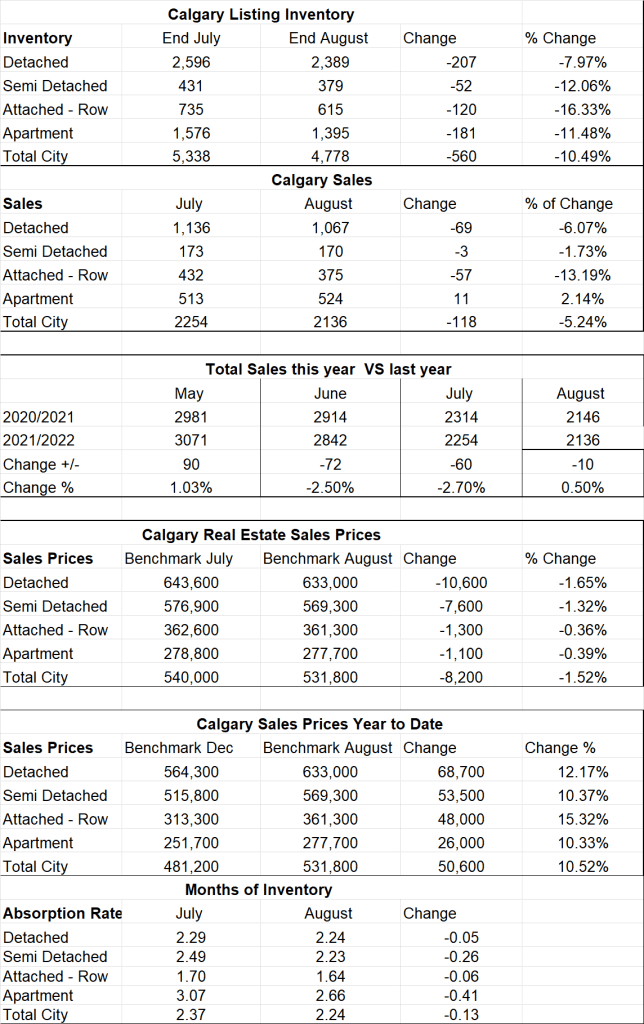

Calgary Listing Inventory

There were only small changes in the listing inventory for the month resulting in 31 less listings as of today compared to May 1, 2023

Calgary Sales:

Sales increased in all sectors this month. The overall increase was 15.99% The different sectors ranged from 13.78% for detached homes to 19.47% for Attached-Row. In my opinion the cause of the increase in sales is because we had substantially more new listings hit the market this month. New listings went from 3132 in April to 3652 in May. Sales should continue to be strong as the demand seems to be much higher than the supply.

Sales Compared to 2022:

It is also important to look at sales compared to the Previous year. Sales for April were 711 less than last year. Again, in my opinion this is simply due to not having enough Inventory on the market.

| Jan | Feb | Mar | Apr | May | June | July | |

| 2022 | 2004 | 3305 | 4091 | 3401 | 3071 | 2842 | 2254 |

| 2023 | 1199 | 1740 | 2432 | 2690 | 3120 | ||

| Change | -805 | -1565 | -1659 | -711 | +57 | ||

| % Change | -40.1% | -47.4% | -40.55% | -20.9% | +1.9% |

Calgary Real Estate Benchmark Sales Prices:

The overall benchmark price increased by $6,200 in May. The largest increase was in the detached sector at $12,100 and the smallest increase was in the Apartment Condo sector at $4,500. My predictions are that this trend will continue as the months of inventory is still very low putting us in deep seller’s market territory.

Calgary Real Estate Benchmark Year to Date Sales Price: See chart below.

For all of Calgary we have so far seen an overall increase of 7.36% or $38,200. The lowest dollar increases so far has been apartment condos at $23,800 and the highest is Detached homes at $54,400.

Current Months of Inventory (Absorption Rate):

Months of Inventory decreased again in all sectors making things even tighter.

My Prediction for what is ahead: Being that we are in a deep Sellers Market, we will continue to see prices increasing. As we have seen all new inventory get sold right away and no net gain, I still have to say this trend is going to continue for the next several months.

Below is a summary of numbers in chart form. All numbers are taken from the Calgary Real Estate Boards monthly Stats package.

All numbers vary by community and price ranges, if you would like stats specifically for your neighbourhood, please contact us.