What is really happening in the Calgary Real Estate Market?

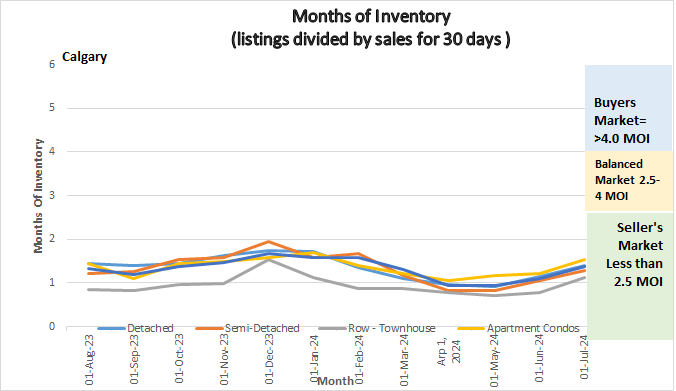

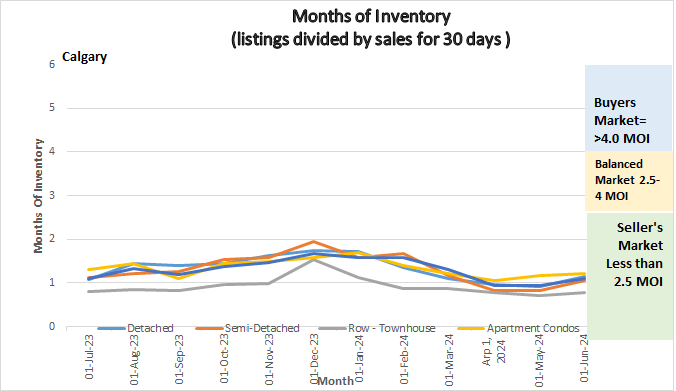

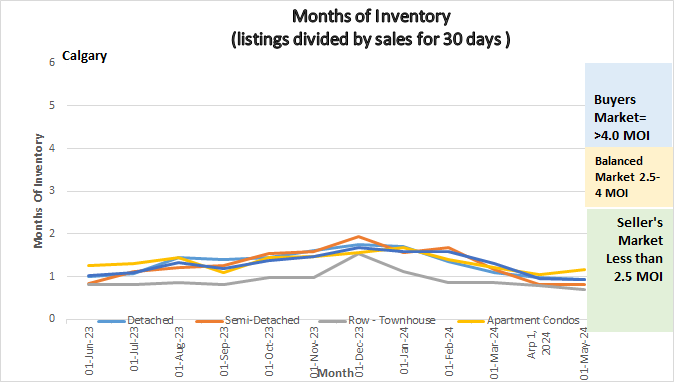

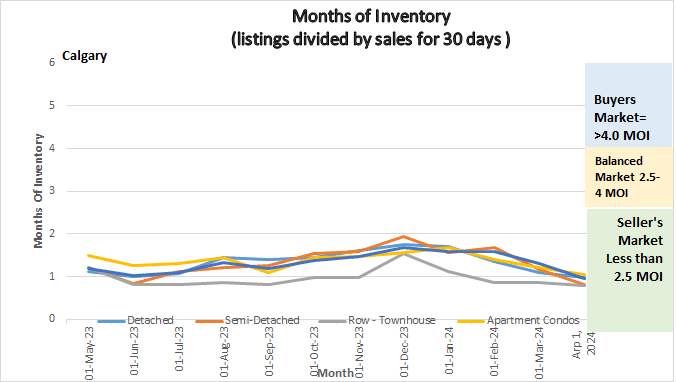

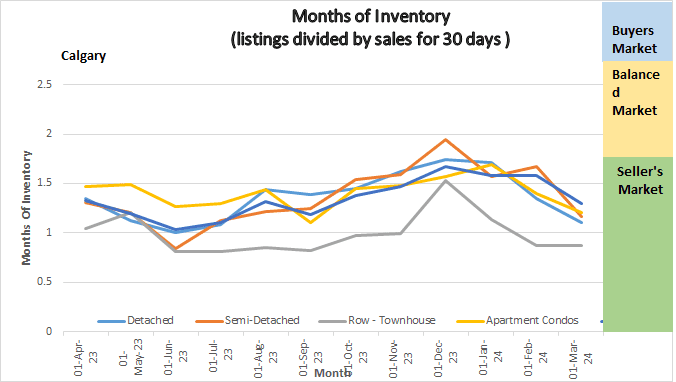

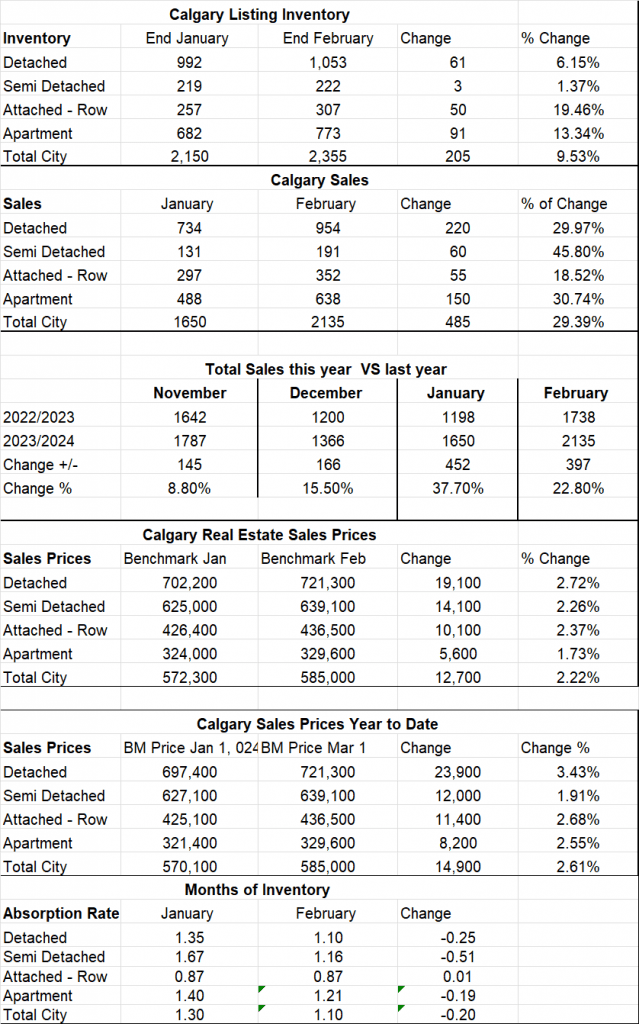

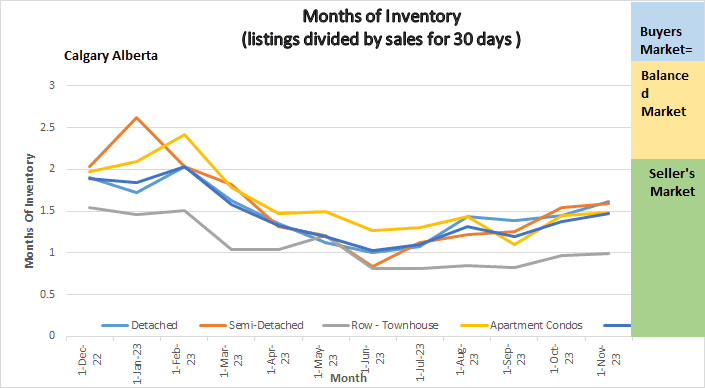

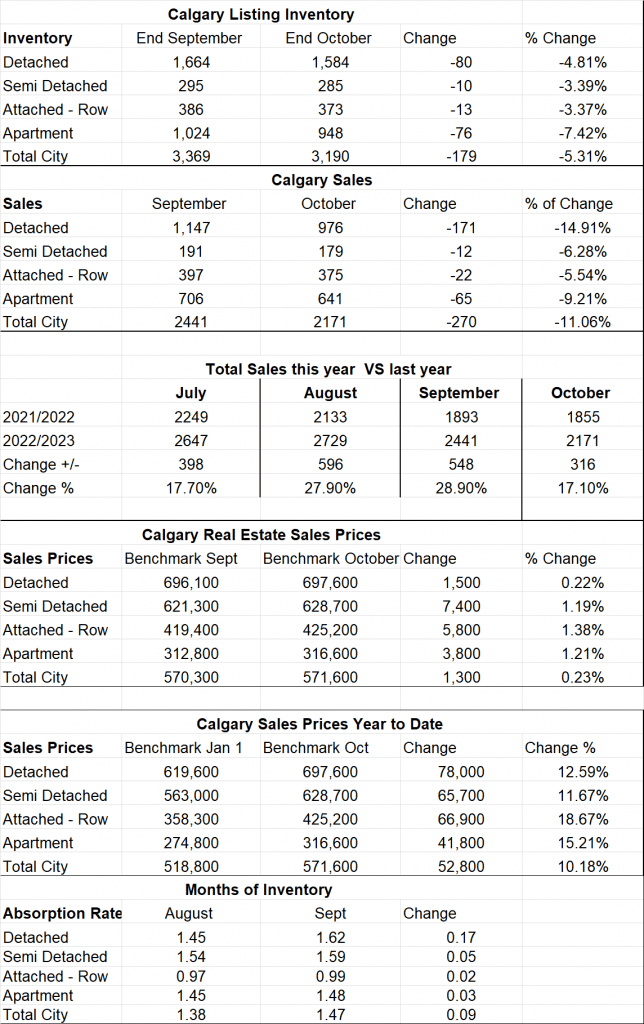

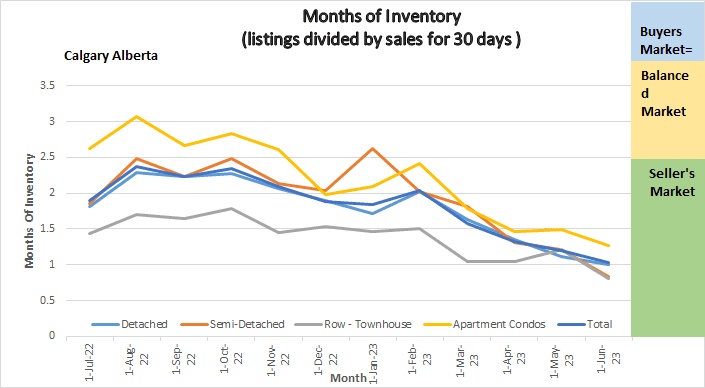

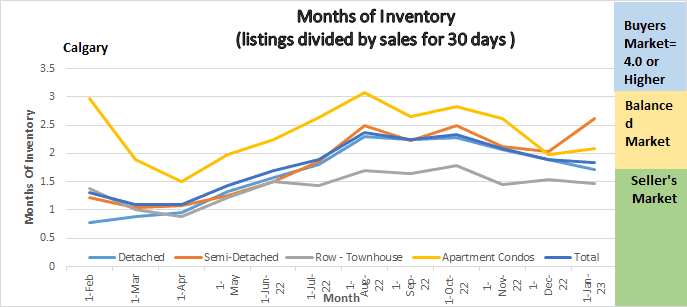

Following is a graph that shows the months of inventory for each housing sector. Looking at a one-year trendline gives you an indication of where things are really heading. As you can see the months of Inventory started increasing for the first time in recent history in June.

Gord’s commentary for the month (just my opinion).

June 2024 Highlights

Change is on the way.

- Inventory continues to rise a little each week.

- The Market is slowing.

- Every Sector remains in a deep Seller’s Market

- Overall Benchmark Prices continue to rise but the increases are getting smaller.

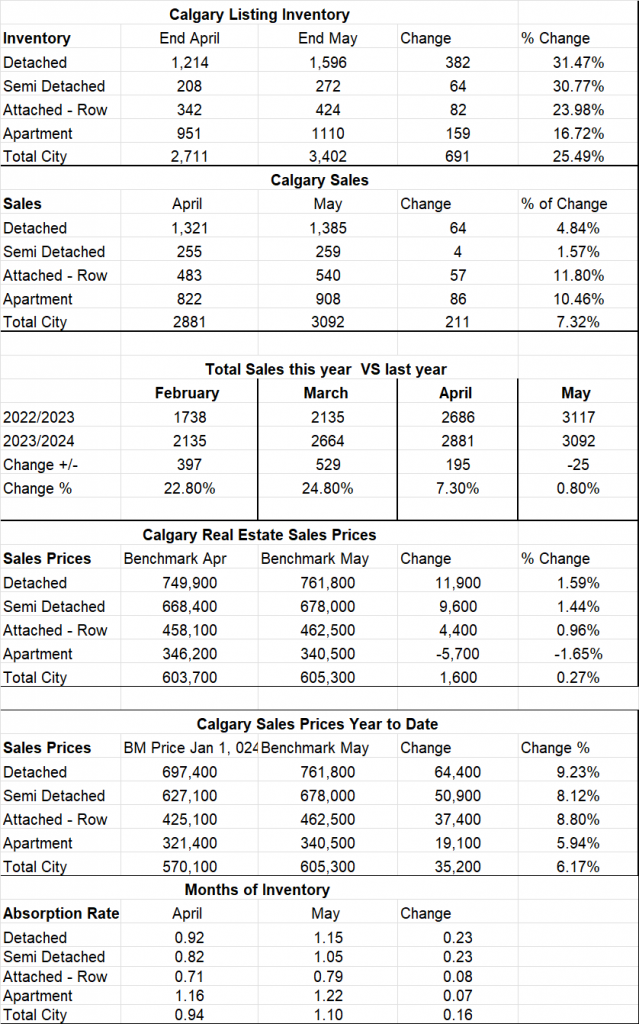

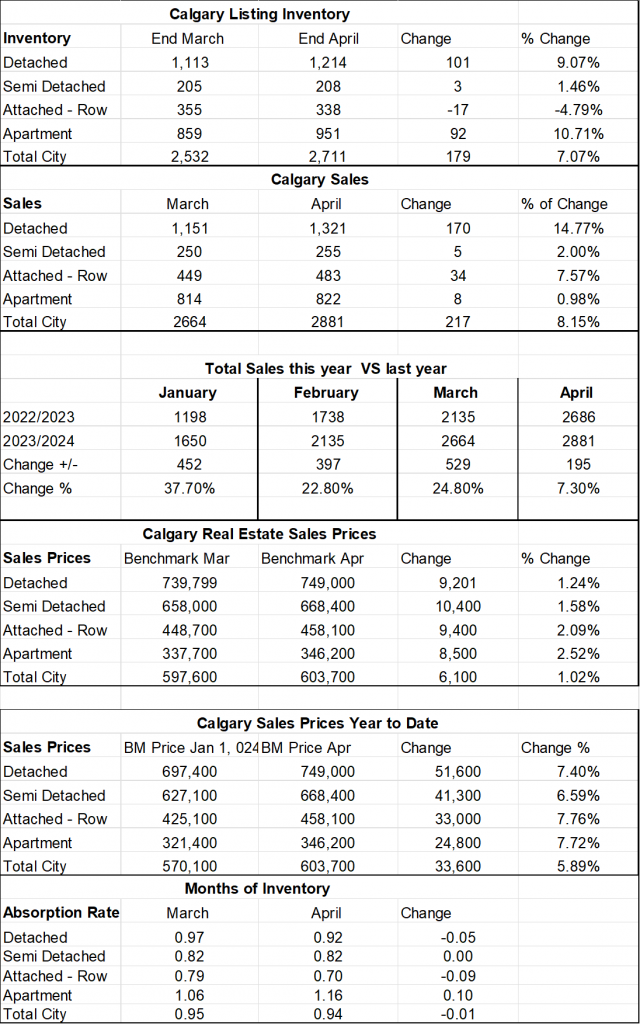

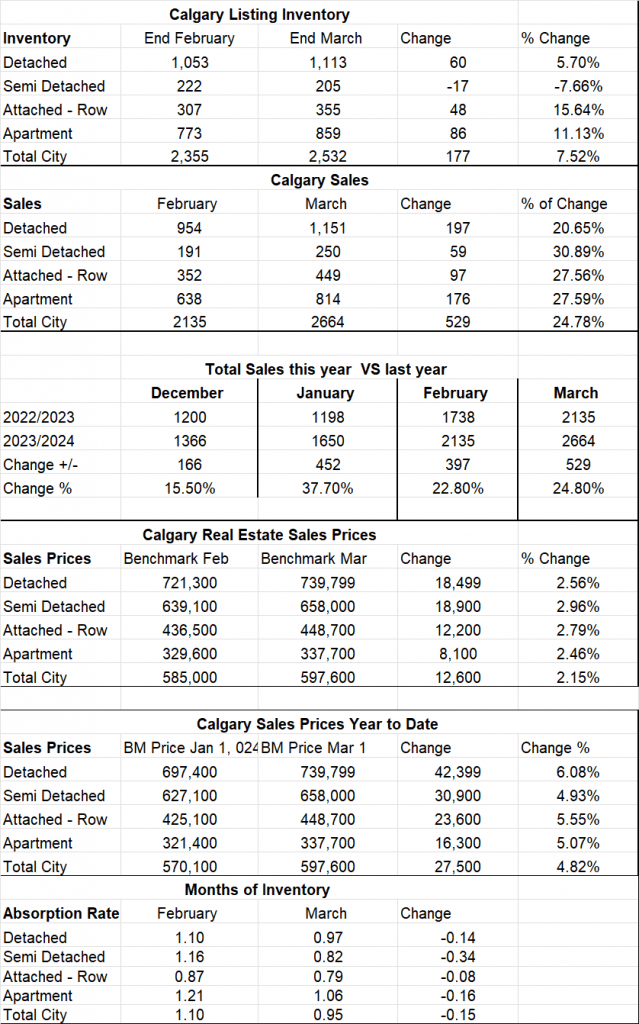

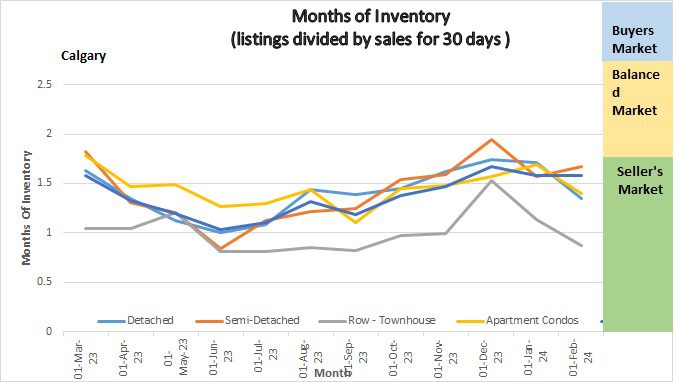

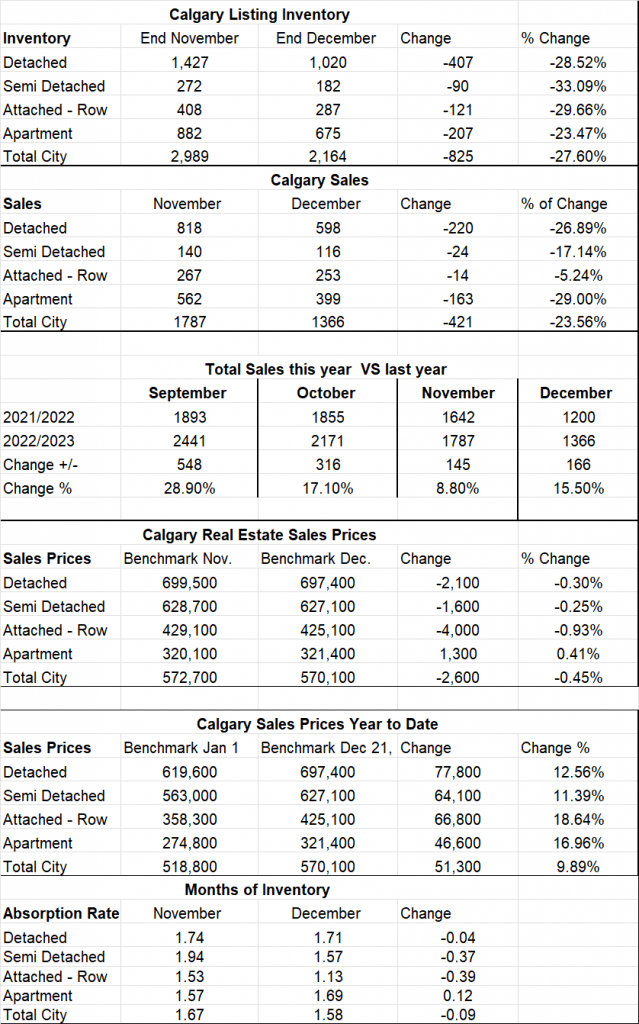

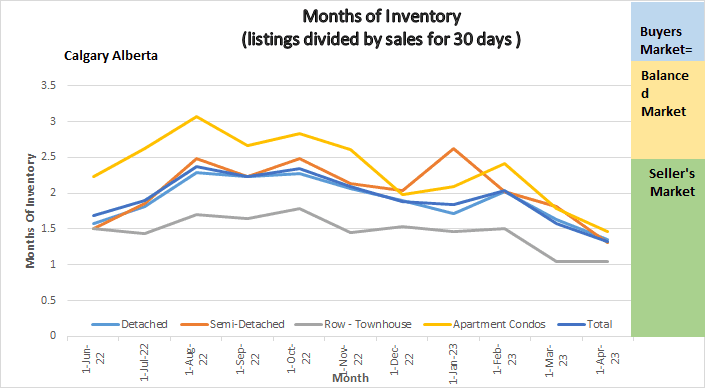

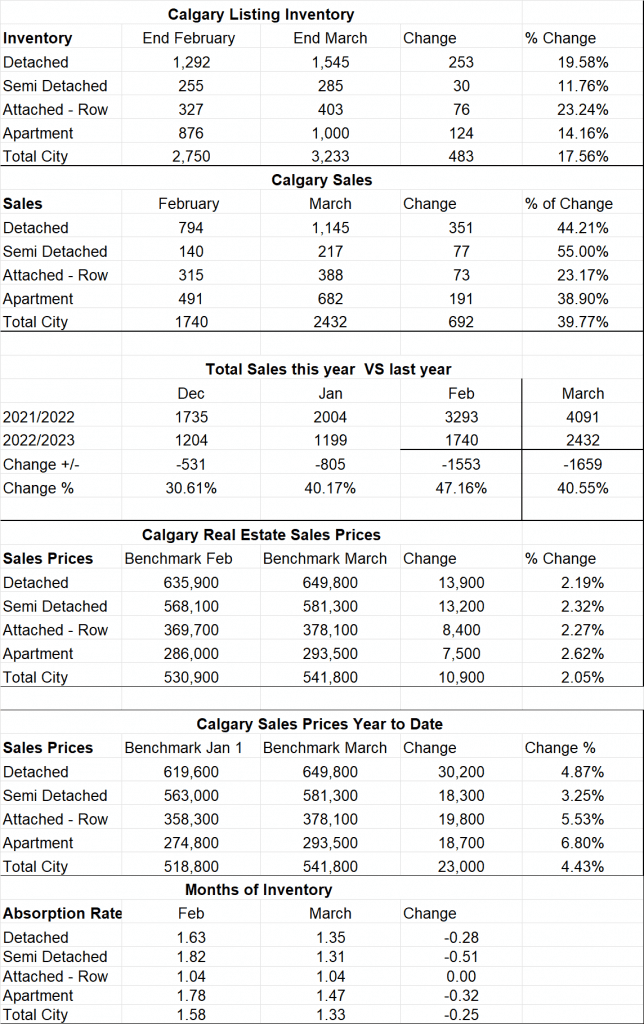

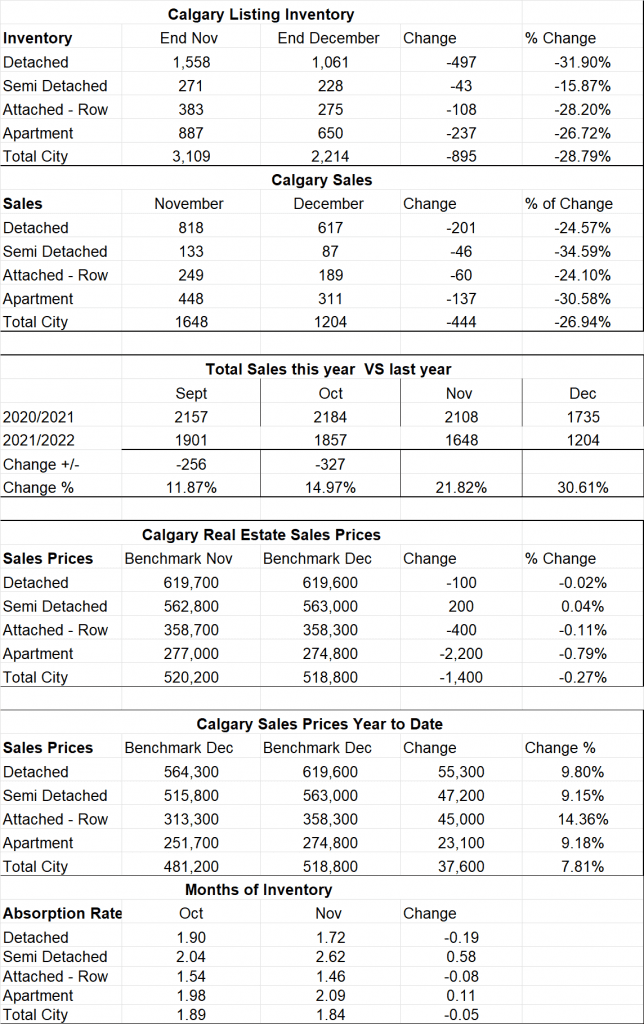

Calgary Listing Inventory

Our listing inventory increased slowly but steady in June. Increases ranged between sectors at 10 % – 12% except the Attached Row Sector which increased by 15.8%.

Calgary Sales:

Sales in June decreased by 11.2% with the smallest decrease in the Detached sector at 7.73% and the largest decrease in the Attached Row sector at 19.26% Sales decreasing in June is a normal trend but its also a big change compared to what we have been seeing the last year. Yes, the market is slowing.

Sales Compared to 2023:

Sales in June compared to 2023 were down 402 sales or 12.8%. This is another indication to me that the market is finally starting to slow.

| Jan | Feb | Mar | Apr | May | June | |

| 2023 | 1198 | 1738 | 2135 | 2686 | 3117 | 3140 |

| 2024 | 1650 | 2135 | 2664 | 2881 | 3092 | 2738 |

| Change | +452 | +397 | +529 | +195 | -25 | -402 |

| % Change | 37.7% | 22.8% | 24.8% | 7.3% | – .8% | -12.8% |

Calgary Real Estate Benchmark Sales Prices:

The overall Benchmark price increased by a total of $2,700 or .45% which is a much smaller increase than what we have been seeing. Sectors increases were consistent from .45% to 1.19%.

Calgary Real Estate Benchmark Year to Date Sales Price: See chart below.

Year to date the entire market has increased by $37,900 or 6.65% which is substantial. Increases for sectors range from Detached Homes (10.07%), Semi-Detached Homes (9.41%), Attached-Row (9.29%), Apartment Condos (7.25%).

Current Months of Inventory (Absorption Rate): Our Months of Inventory increased in all sectors by a little. All sectors were similar with increases between .24 and .34. All Sectors are between 1.13 months to 1.54 month putting every sector still in a Sellers Market Position.

My Prediction for what is ahead:

Based on what I am seeing I believe we will continue to see our Inventory grow over the next several months. If the same trend continues then we would hit a balanced market withing 3 to 4 months.

*Below is a summary of numbers in chart form. All numbers are taken from the Calgary Real Estate Boards monthly Stats package.

*All numbers vary by community and price ranges, if you would like stats specifically for your neighbourhood, please contact us.