What is really happening in the Calgary Real Estate Market?

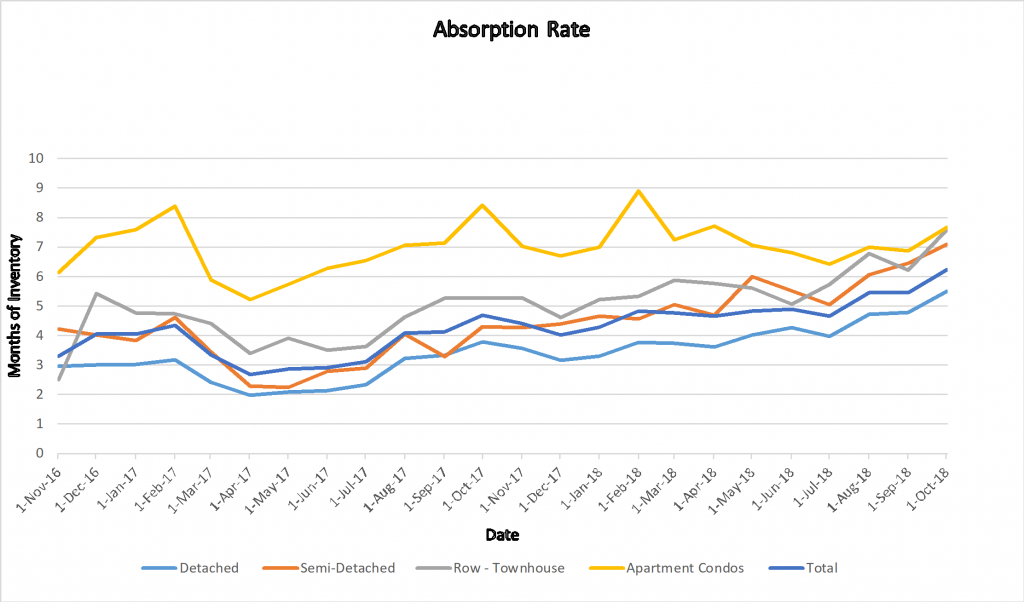

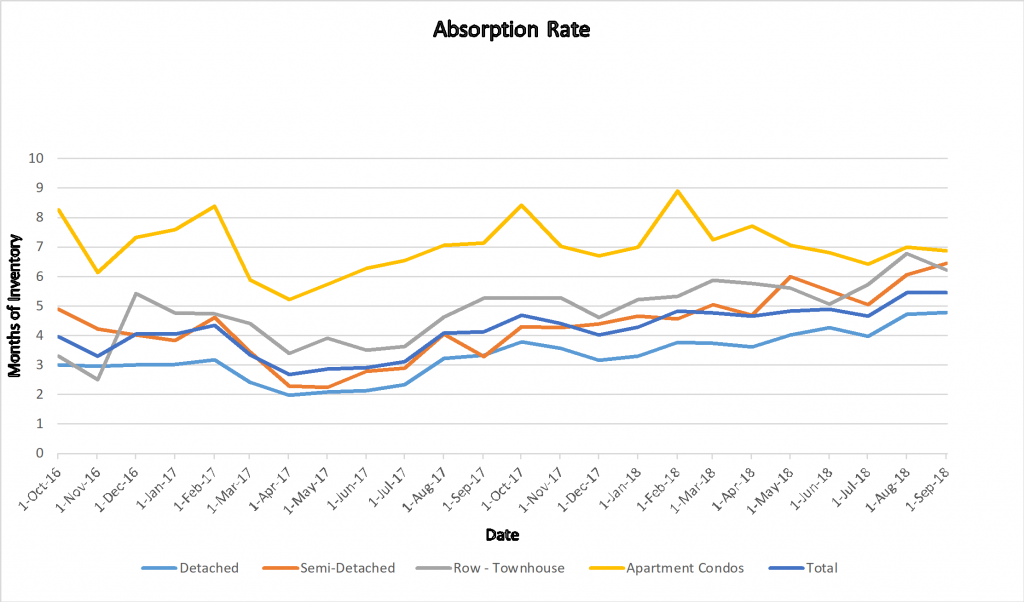

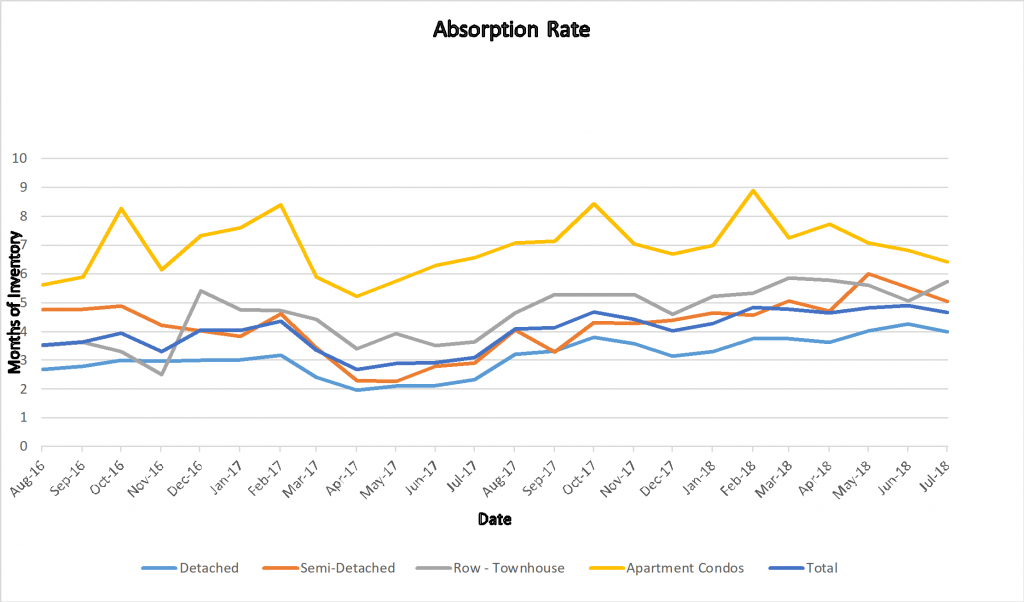

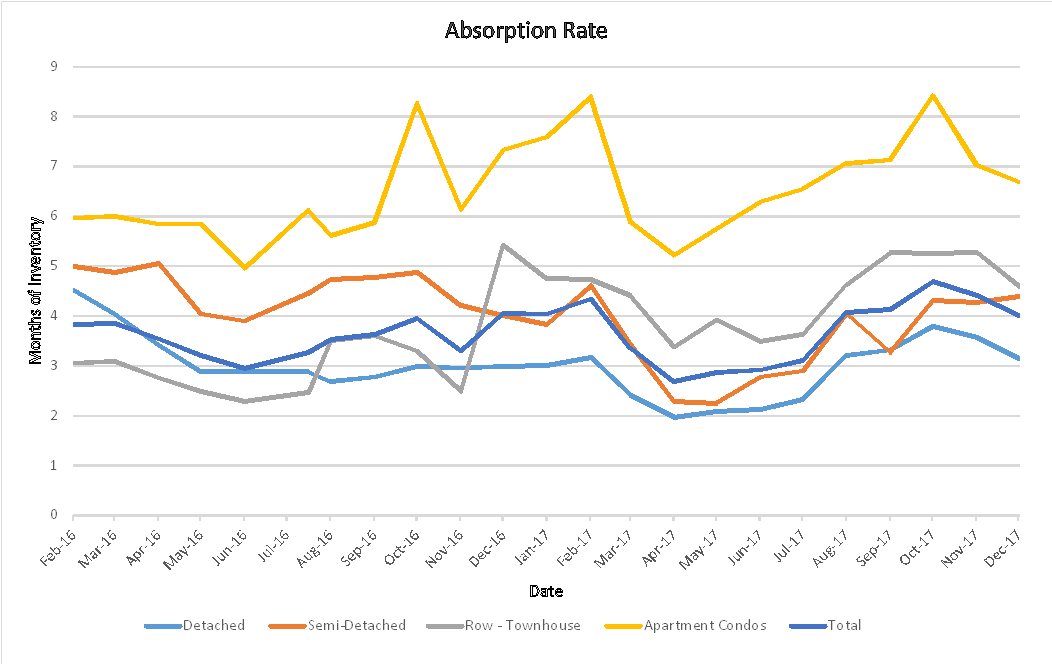

Current Months of Inventory:

Good news for the Calgary Real Estate Market. Three months in a row we have a trend with the months of inventory decreasing. April saw all sectors decrease with the largest decrease in Apartment Condos which decreased by 1.71 months. Detached and Attached-Row houses. Noteworthy is that Detached homes are nearing a balanced market again.

| End of | Mar 2019 | Apr 2019 | Change |

| Detached | 4.15 | 3.97 | -0.18 |

| Semi Detached | 5.32 | 4.63 | -0.69 |

| Attached – Row | 5.44 | 5.29 | -0.15 |

| Apartment | 7.87 | 6.16 | -1.71 |

| Total City | 4.96 | 4.57 | -0.40 |

Calgary Listing Inventory

In April, our inventory increased in all categories except Semi-Detached which saw a small decrease. This increase is totally expected as we starting to enter the spring market. If the increase is balanced with an increase in sales the market will continue to get healthier.

| Inventory (End of) | Mar 2019 | Apr 2019 | Change |

| Detached | 3393 | 3691 | 298 |

| Semi Detached | 787 | 773 | -14 |

| Attached – Row | 947 | 1053 | 106 |

| Apartment | 1488 | 1546 | 58 |

| Total Calgary | 6595 | 7063 | 468 |

Calgary Sales:

Sales for April increased in all sectors compared to March. Sales increasing is again an expected change as we move into the spring market. The good news is that sales increases are outpacing listing inventory moving the entire market closer to balanced.

| Calgary Sales | Mar 2019 | Apr 2019 | Change | % Change |

| Detached | 818 | 930 | 112 | 13.69% |

| Semi Detached | 148 | 167 | 19 | 12.84% |

| Attached – Row | 174 | 199 | 25 | 14.37% |

| Apartment | 189 | 251 | 62 | 32.80% |

| Total City | 1329 | 1547 | 218 | 16.40% |

***Sales Compared to last year***

In April our sales showed an increase over last April which is the first time in a few years that this has happened. Hoping the trend continues.

| Jan | Feb | Mar | Apr | May | June | July | Aug | Sept | Oct | Nov | Dec | |

| 2018 | 102% | 82% | 72% | 80% | 82% | 89% | 95% | 93% | 85.9% | 89.9% | 83.0 | 78.6 |

| 2019 | 83.8% | 89.6% | 97.1% | 102.2% |

Calgary Real Estate Sales Prices:

April saw a small increase in prices in all sectors except for Apartment Condo’s which decreased by only $200.

| Sales Prices | Mar 2018 Benchmark Price | Apr 2019 Benchmark Price | Change |

| Detached | 475,800 | 478,700 | 2,900 |

| Semi Detached | 391,000 | 395,300 | 4,300 |

| Attached – Row | 284,900 | 284,900 | 0 |

| Apartment | 250,600 | 250,400 | -200 |

| Total City | 413,900 | 415,900 | 2,000 |

Sales Prices “Year to Date”

Although prices are up a little in April, we have some catch up to do as the earlier months saw losses.

| Sales Prices | Jan 2019 Benchmark Price | Apr 30, 2019 Benchmark Price | Change

$ |

% Change |

| Detached | 481,400 | 478,700 | -2,700 | -0.56% |

| Semi Detached | 397,500 | 395,300 | -2,200 | -0.55% |

| Attached – Row | 288,400 | 284,900 | -3,500 | -1.21% |

| Apartment | 251,500 | 250,400 | -1,100 | -0.44% |

| Total City | 418,500 | 415,900 | -2,600 | -0.62% |

Explanation of our Calgary Real Estate Market Snapshot.

Stay ahead of everyone else by following our Monthly Market Snapshot of the Calgary Real Estate Market. This shows what’s really happening! The market is driven by supply and demand so here we show the inventory (supply) and sales (demand) and most importantly the relationship between the two and how it affects the price of Calgary Real Estate. A simple way to keep up to date with how the market is trending and to stay ahead of most! All numbers are taken from the Calgary Real Estate Boards Stats package for Realtors. I have also included some general comments which are simply my opinion.

Months of Inventory: If we did not list any more homes this is how many months it would take to deplete inventory.

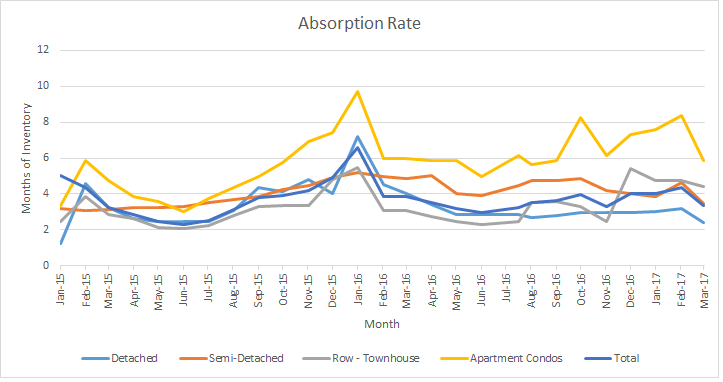

Months of Inventory/Absorption Rate – the inventory divided by the number of sales in the last month). What does this mean you might ask?

| Buyer’s Market | >4.0 | Drives prices down |

| Balanced Market | Between 2.4 to 4.0 | Prices typically remain stable |

| Seller’s Market | <2.4 | Drives prices up |

**Please note that these numbers include only Calgary and do change on a community basis, and more so for towns. This report does not include rural properties and does not consider differences in different price ranges. If you would like to find stats on your community just let me know. If you have any questions about this summary or about Real Estate in general, please feel free to contact us.