What is really happening in the Calgary Real Estate Market?

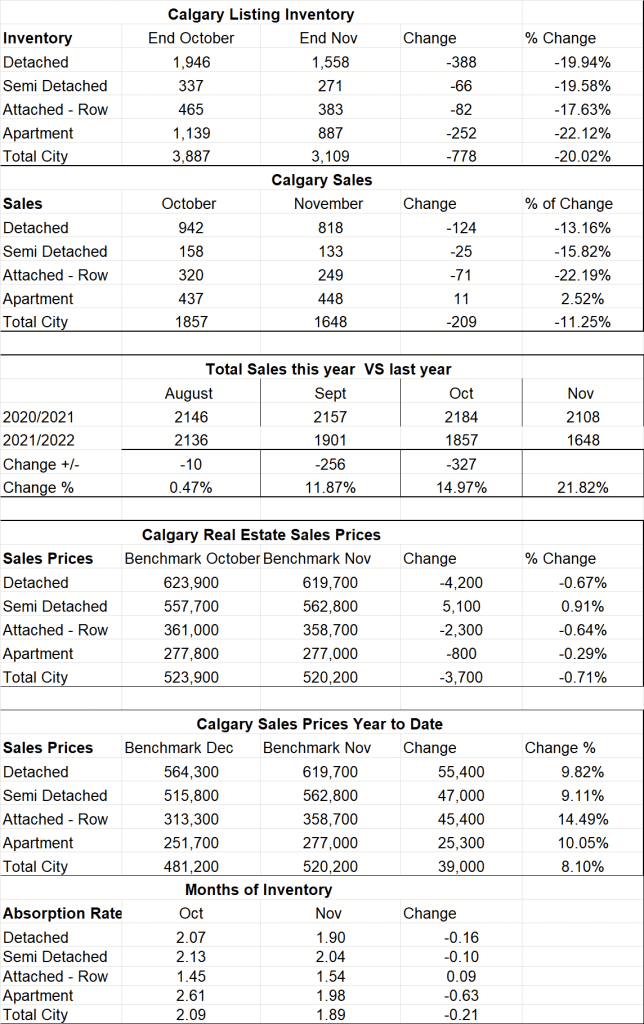

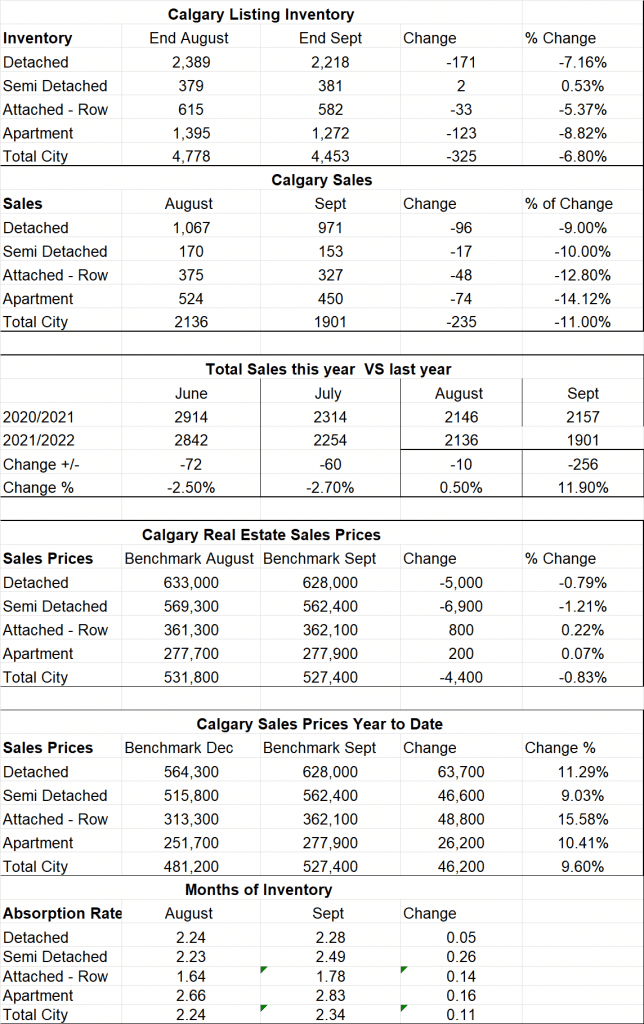

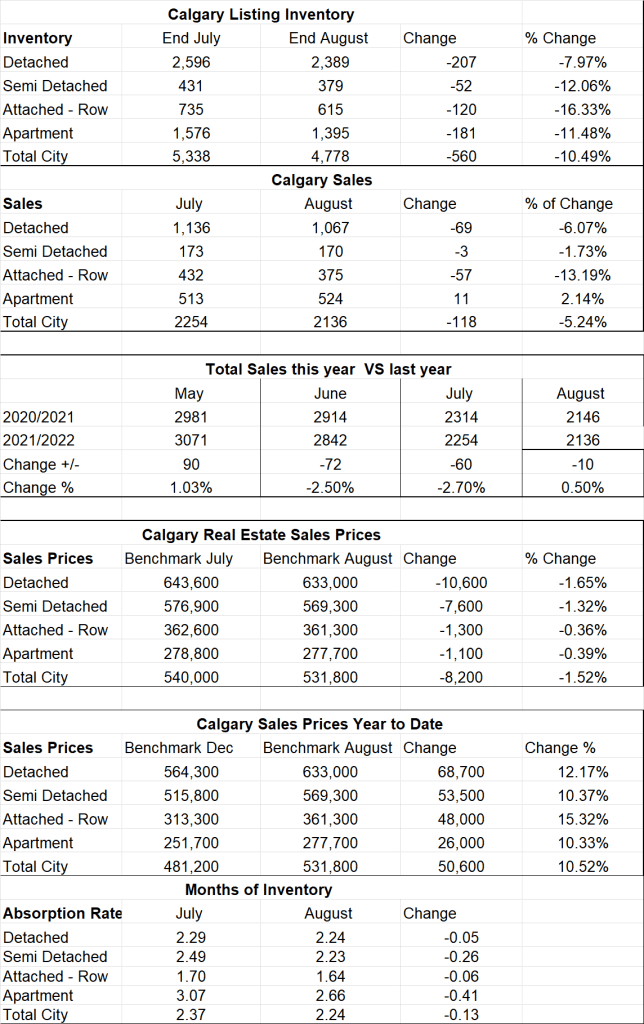

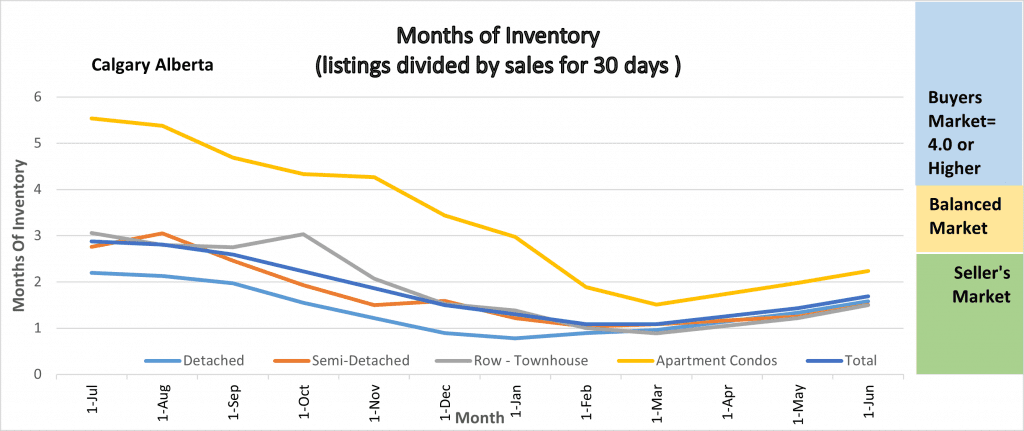

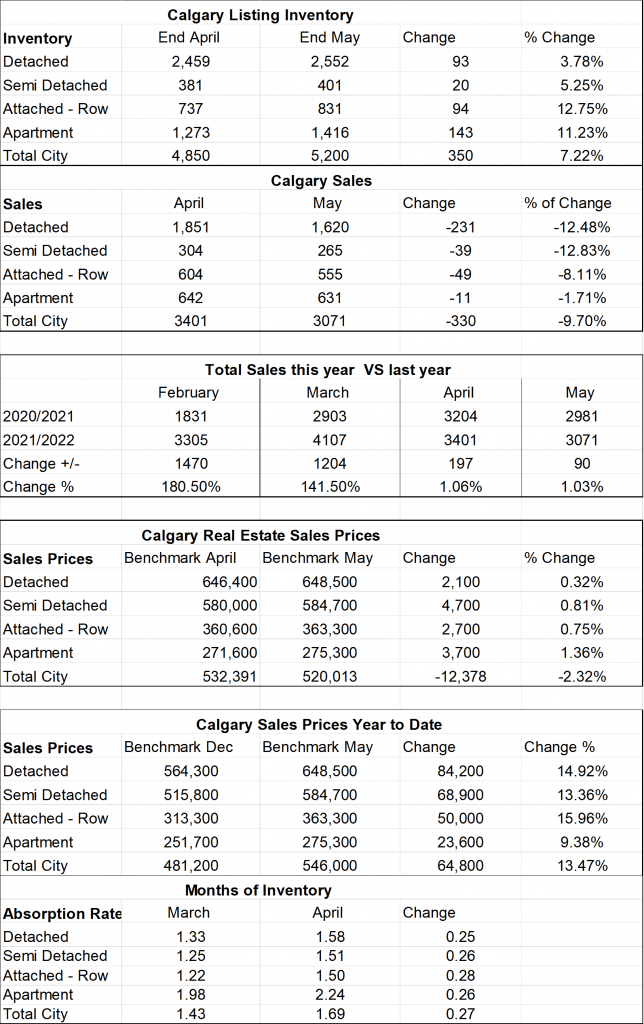

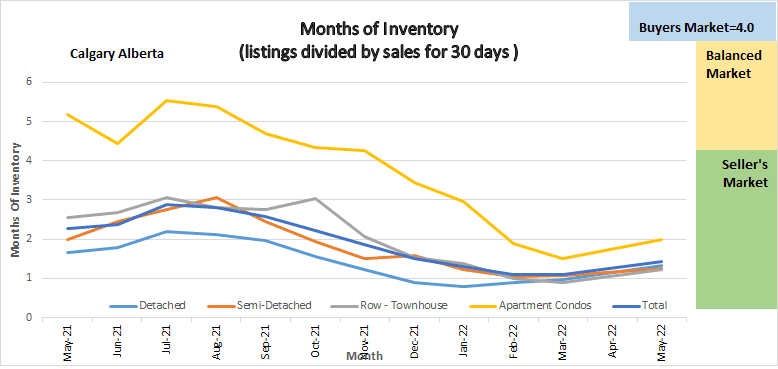

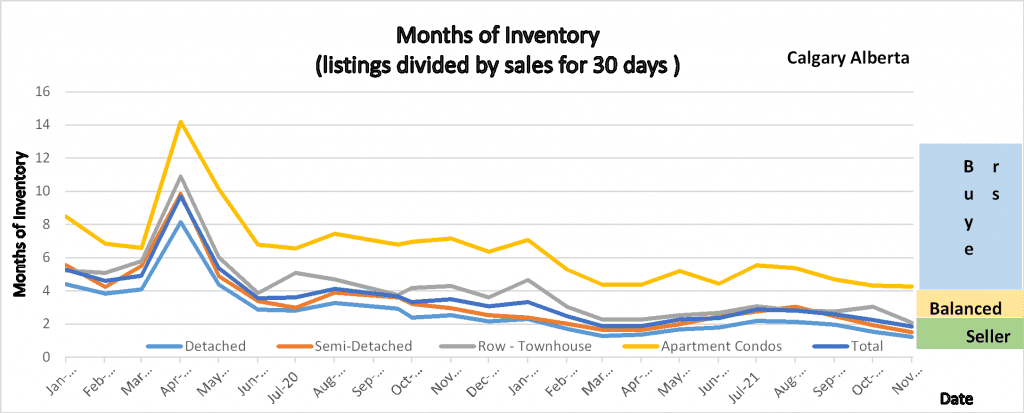

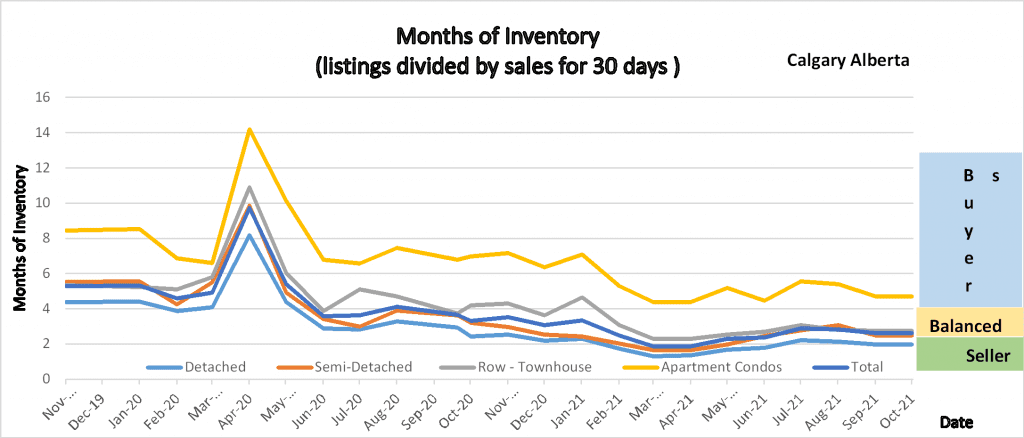

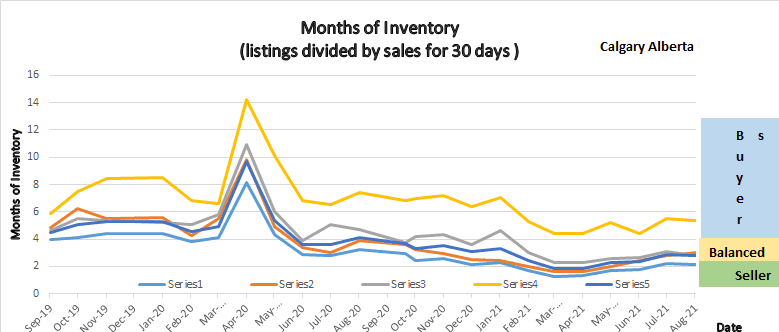

Following is a graph that shows the months of inventory for each housing sector. Looking at a one-year trendline gives you an indication of where things are really heading.

Chart shows the months of Inventory for all sectors of the Calgary Real Estate Market for the last year.

Gord’s commentary for the month (just my opinion).

November 2022 Highlights

The Calgary Market continues to stay strong!

- Inventory continues to decline

- Sales declined but not as much as Inventory

- Months of Inventory declined again

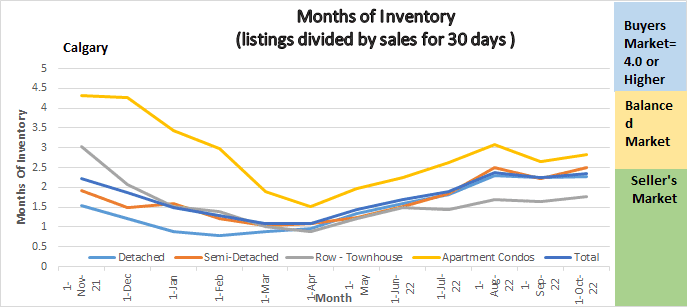

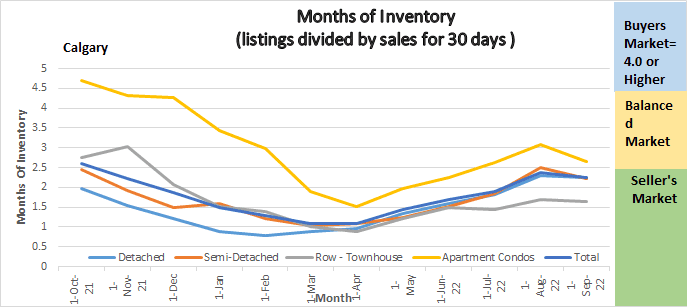

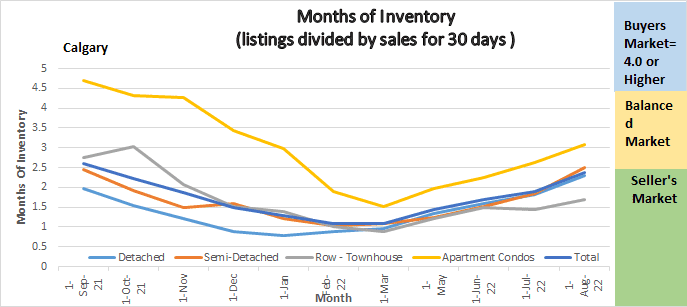

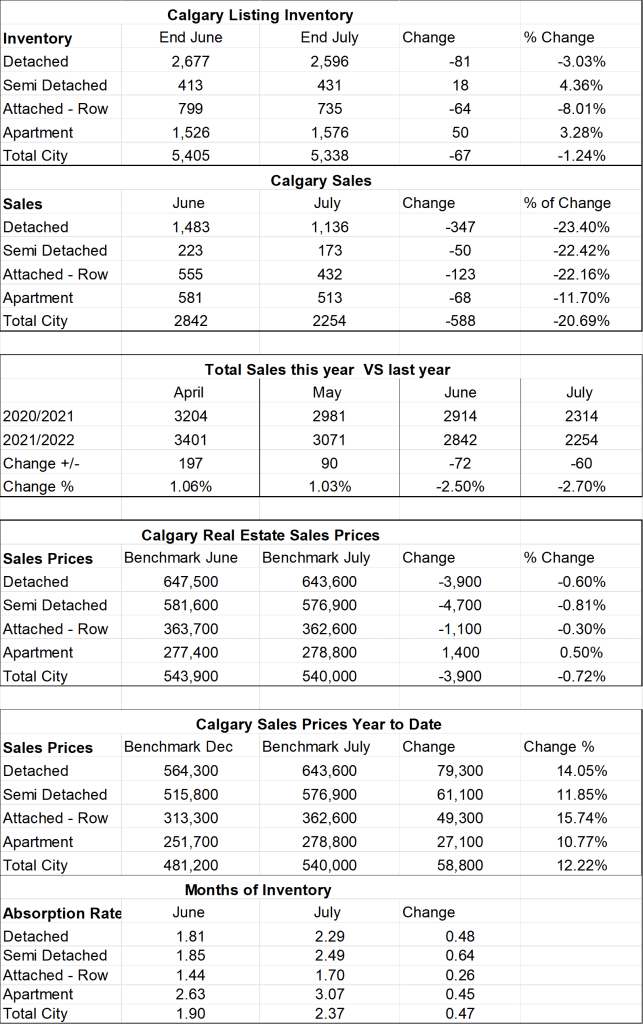

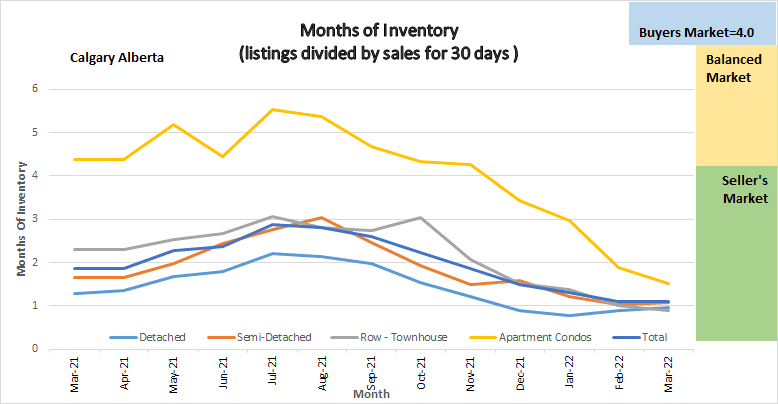

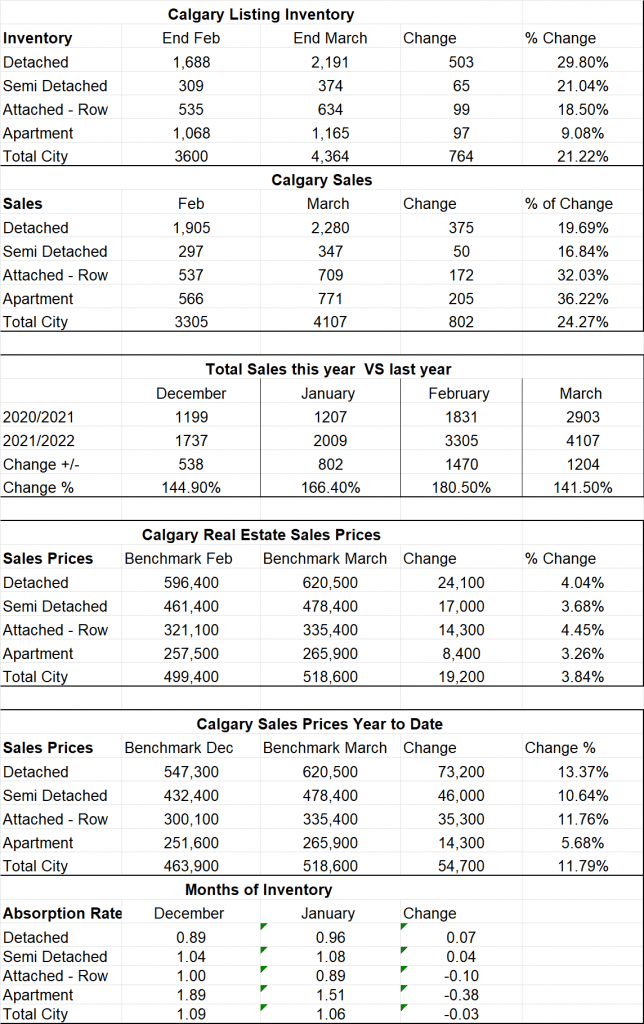

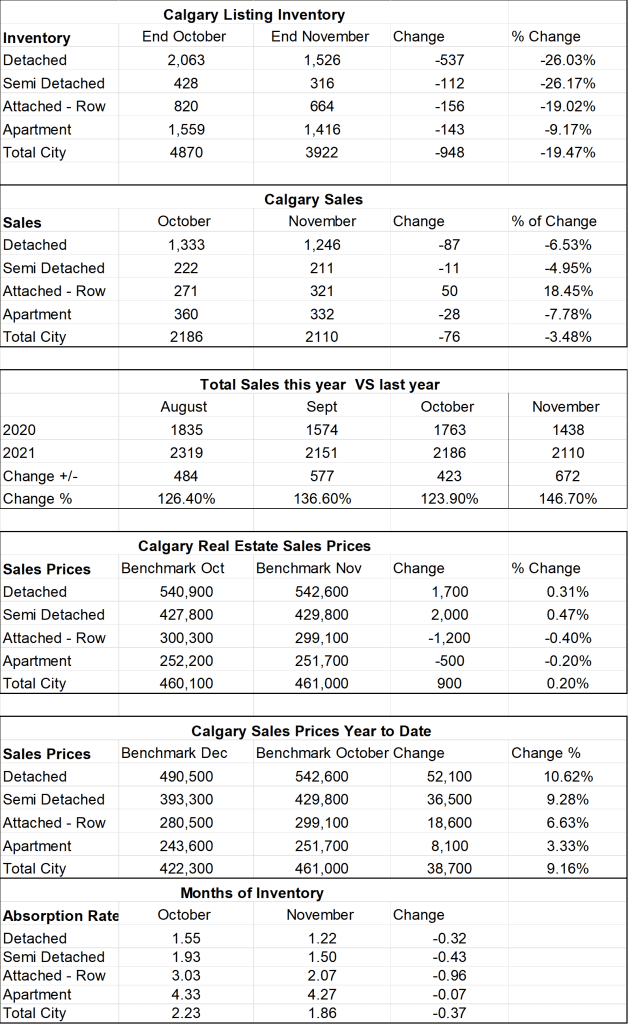

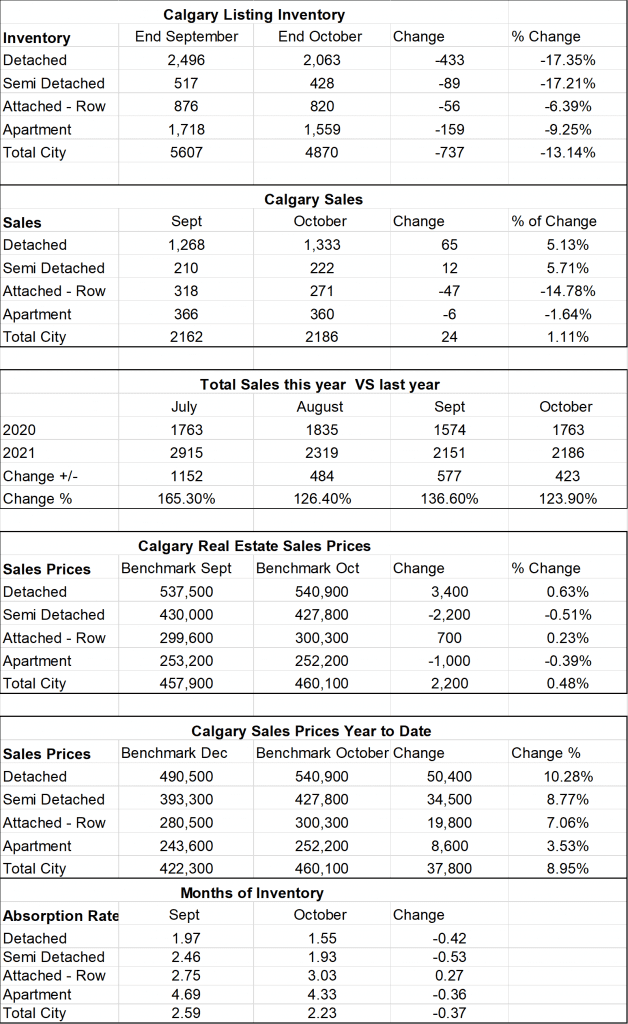

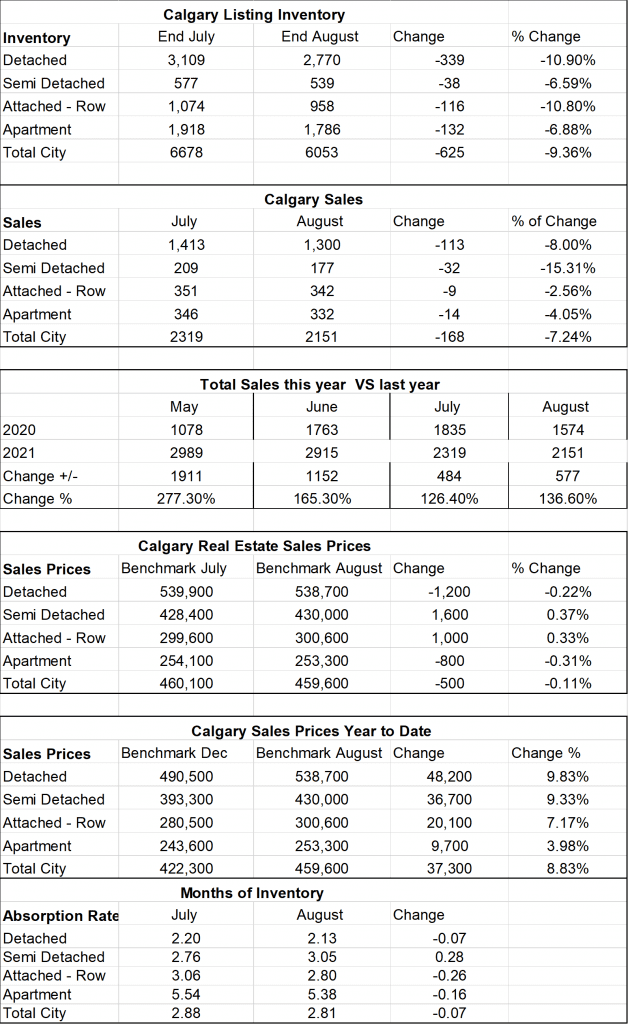

Calgary Listing Inventory

Listing Inventory in all sectors declined this month by 20.02% overall. The largest % decline was in the Apartment condo sector followed by the detached home sector. It is very normal to see our Inventory decline at this time of year as many people do not want to sell their homes over the holiday season.

Calgary Sales:

All sectors saw a decrease of sales in November except the Apartment Condo sector which saw a slight increase of 2.52% over October. Again, a decline in sales is normal at this time of year with Christmas coming (yes, already).

Sales Compared to 2021:

It is also important to look at sales compared to the Previous year. Sales for November were down 21.8% when compared to last November. Although this looks like an exceptionally substantial number, we also need to consider that Last November is when things in the Calgary Real Estate Market started getting heated so not meeting last years sales does not concern me at all. Sales in November were still 12% above the long-term average.

| Jan | Feb | Mar | Apr | May | June | July | |

| 2021 | 1207 | 1831 | 2903 | 3204 | 2981 | 2914 | 2314 |

| 2022 | 2009 | 3305 | 4107 | 3401 | 3071 | 2842 | 2254 |

| Change | + 802 | 1474 | +1204 | +197 | 90 | -72 | -60 |

| % Change | + 66.4% | +180.5% | +141.5% | +1.06 | +1.03% | 2.5% | 2.7% |

| Aug | Sept | Oct | Nov | Dec | |

| 2021 | 2146 | 2157 | 2184 | 2108 | |

| 2022 | 2136 | 1901 | 1857 | 1648 | |

| Change | -10 | -256 | -327 | -460 | |

| % Change | -.5% | -11.9% | -17.6% | -21.8% |

Calgary Real Estate Benchmark Sales Prices:

The benchmark price for all Detached homes, Attached Row homes and Apartment Condos declined by $4,200, $2,300, and $800, respectively. The benchmark price for Semi-Detached homes increased by $5,100 I believe the reason for this is some buyers are no longer able to buy detached homes with the price and interest rate increases pushing them towards the Semi-Detached sector.

Calgary Real Estate Benchmark Year to Date Sales Price: See chart below.

Year to date the Calgary market has increased by 8.1%. See stats below for sector breakdowns.

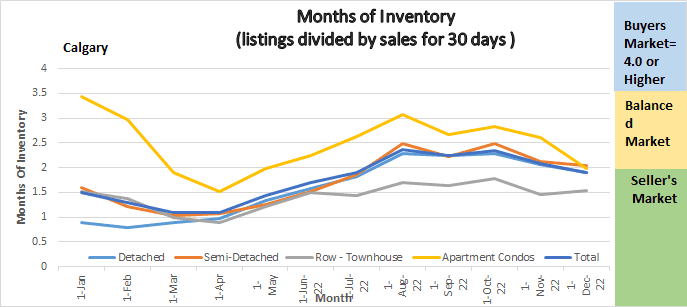

Current Months of Inventory (Absorption Rate):

The months of inventory for all sectors decreased again this month in all sectors except Attached Row Homes which increased by .63 The total month of inventory is at 1.89 putting us clearly in a seller’s market position again. If the month of Inventory continues to decrease, then we could end up with another wild and crazy Jan – Feb – March.

What might the last quarter of 2022 bring: (again just my opinion)

Based on what I am seeing with the Inventory, my prediction is that we are going to be in a tight market for the next few months. I personally have several buyers who are just waiting for something to come on the market that fits their criteria. I see this trend continuing and therefore prices are likely to increase again in the first quarter of next year.

Below is a summary of numbers in chart form. All numbers are taken from the Calgary Real Estate Boards monthly Stats package.

All numbers vary by community and price ranges, If you would like stat specifically for your neighborhood please contact us.